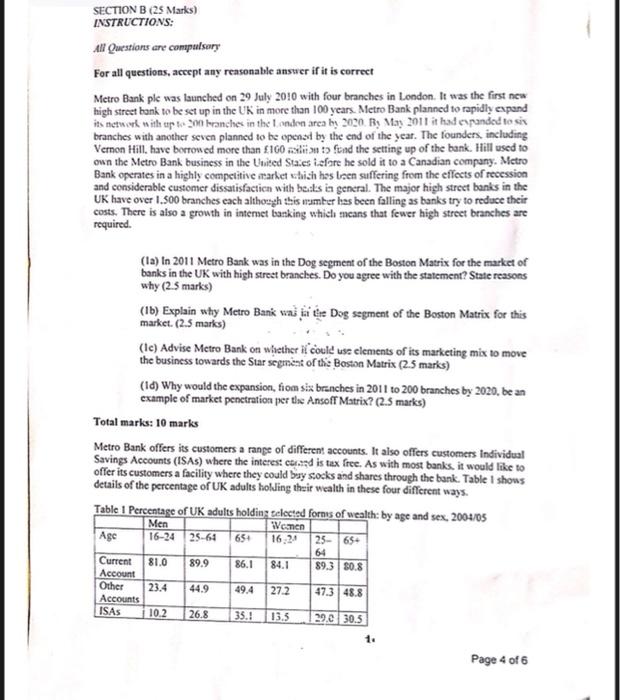

Question: SECTION B (25 Marks) INSTRUCTIONS: All Questions are compulsory For all questions, accept any reasonable answer if it is correct Metro Bank ple was launched

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock