Question: SECTION B (30 Marks) There are TWO (2) questions in this section Answer ALL questions on the ANSWER BOOKLET. Question 1 Answer the following questions.

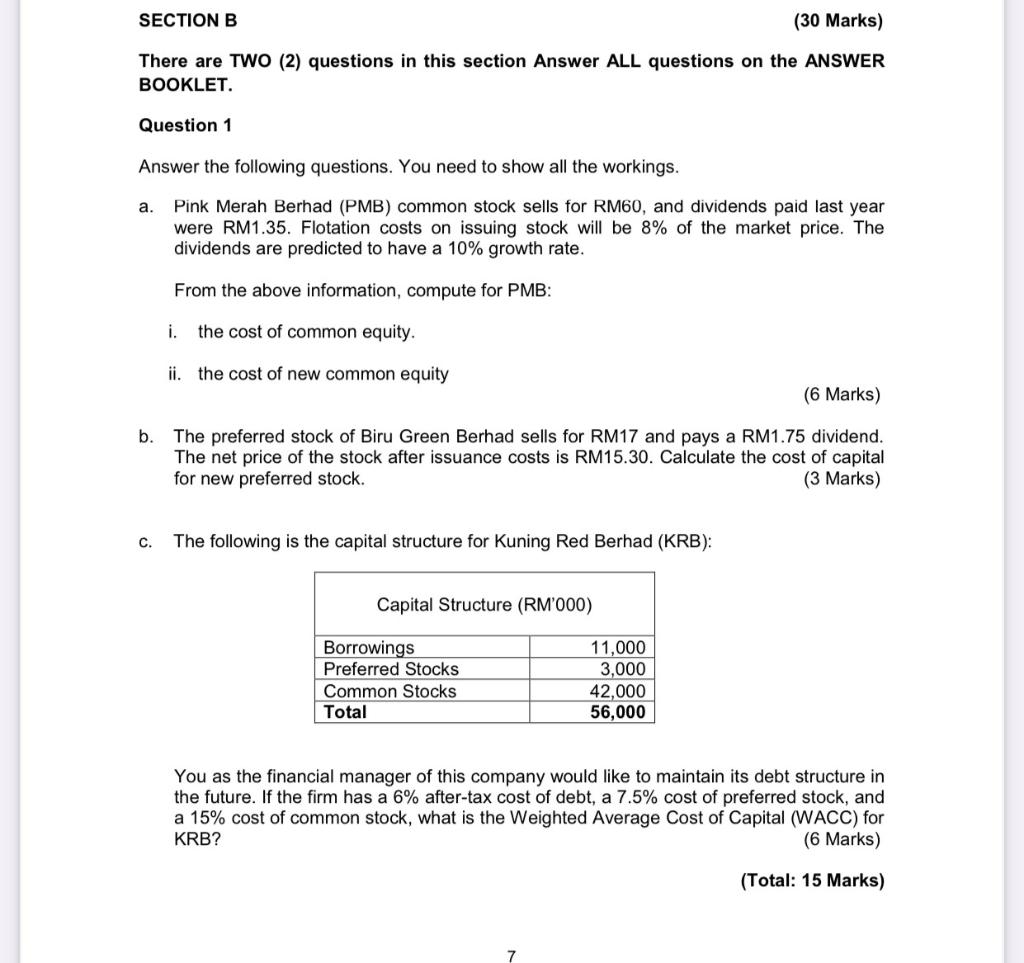

SECTION B (30 Marks) There are TWO (2) questions in this section Answer ALL questions on the ANSWER BOOKLET. Question 1 Answer the following questions. You need to show all the workings. a. Pink Merah Berhad (PMB) common stock sells for RM60, and dividends paid last year were RM1.35. Flotation costs on issuing stock will be 8% of the market price. The dividends are predicted to have a 10% growth rate. From the above information, compute for PMB: i. the cost of common equity. ii. the cost of new common equity (6 Marks) b. The preferred stock of Biru Green Berhad sells for RM17 and pays a RM1.75 dividend. The net price of the stock after issuance costs is RM15.30. Calculate the cost of capital for new preferred stock. (3 Marks) C. The following is the capital structure for Kuning Red Berhad (KRB): Capital Structure (RM'000) Borrowings Preferred Stocks Common Stocks Total 11,000 3,000 42,000 56,000 You as the financial manager of this company would like to maintain its debt structure in the future. If the firm has a 6% after-tax cost of debt, a 7.5% cost of preferred stock, and a 15% cost of common stock, what is the Weighted Average Cost of Capital (WACC) for KRB? (6 Marks) (Total: 15 Marks) 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts