Question: Section B (50 marks) [25 marks each) 1. Washington Mint is a U.S. based coin minting company. The company made a bulk order for copper

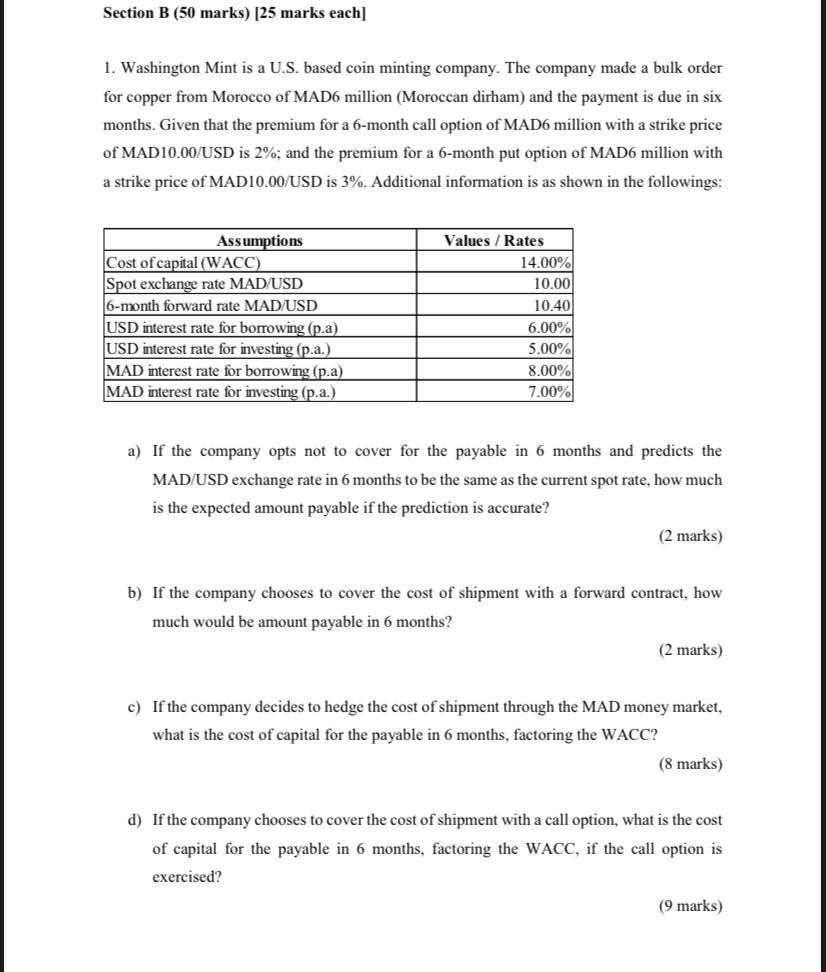

Section B (50 marks) [25 marks each) 1. Washington Mint is a U.S. based coin minting company. The company made a bulk order for copper from Morocco of MAD6 million (Moroccan dirham) and the payment is due in six months. Given that the premium for a 6-month call option of MAD6 million with a strike price of MAD10.00/USD is 2%; and the premium for a 6-month put option of MAD6 million with a strike price of MAD10.00/USD is 3%. Additional information is as shown in the followings: Assumptions Cost of capital (WACC) Spot exchange rate MAD/USD 6-month forward rate MAD/ USD USD interest rate for borrowing (p.a) USD interest rate for investing (p.a.) MAD interest rate for borrowing (p.a) MAD interest rate for investing (p.a.) Values / Rates 14.00% 10.000 10.40 6.00% 5.00% 8.00% 7.00% a) If the company opts not to cover for the payable in 6 months and predicts the MAD USD exchange rate in 6 months to be the same as the current spot rate, how much is the expected amount payable if the prediction is accurate? (2 marks) b) If the company chooses to cover the cost of shipment with a forward contract, how much would be amount payable in 6 months? (2 marks c) If the company decides to hedge the cost of shipment through the MAD money market, what is the cost of capital for the payable in 6 months, factoring the WACC? (8 marks) d) If the company chooses to cover the cost of shipment with a call option, what is the cost of capital for the payable in 6 months, factoring the WACC, if the call option is exercised? (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts