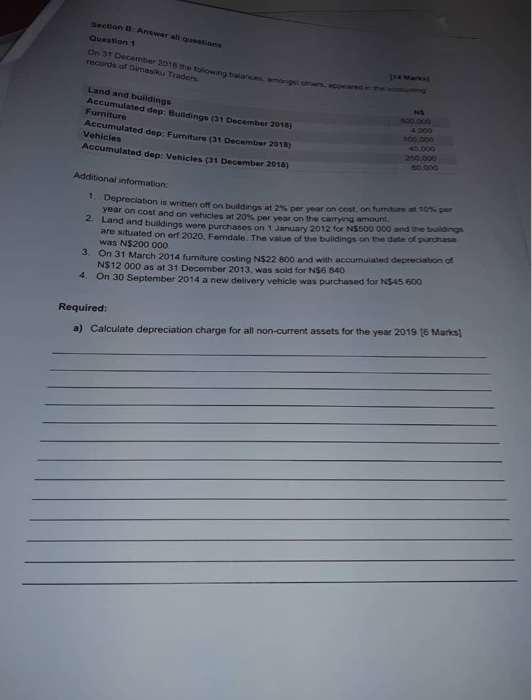

Question: Section B Answer all questions Question 1 On 31 December 2018 the towing balances amongsted records of Simasi Traders Land and buildings Accumulated dep: Buildings

Section B Answer all questions Question 1 On 31 December 2018 the towing balances amongsted records of Simasi Traders Land and buildings Accumulated dep: Buildings (31 December 2016) Furniture Accumulated dep: Furniture (31 December 2016) Vehicles Accumulated dep: Vehicles (31 December 2018) 500.000 100.000 200.000 B0.000 Additional information: 1. Depreciation is written off on buildings at 2% per year on cost, on future at 10% per year on cost and on vehicles at 20% per year on the carrying amount 2. Land and buildings were purchases on 1 January 2012 for $500 000 and the buildings are situated on erf 2020, Ferndale. The value of the buildings on the date of purchase was N$200 000 3. On 31 March 2014 furniture costing N522 800 and with accumulated depreciation of NS 12 000 as at 31 December 2013, was sold for N56 840 4. On 30 September 2014 a new delivery vehicle was purchased for N$45 600 Required: a) Calculate depreciation charge for all non-current assets for the year 2019 [6 Marks) b) Show the Property, plant and equipment schedule as at 31 Dec 2019 18 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts