Question: SECTION B: Answer ALL THREE (3) questions. (60 marks) QUESTION 1 (a) Robinson Corporation gathered the following data from its accounting records for the month

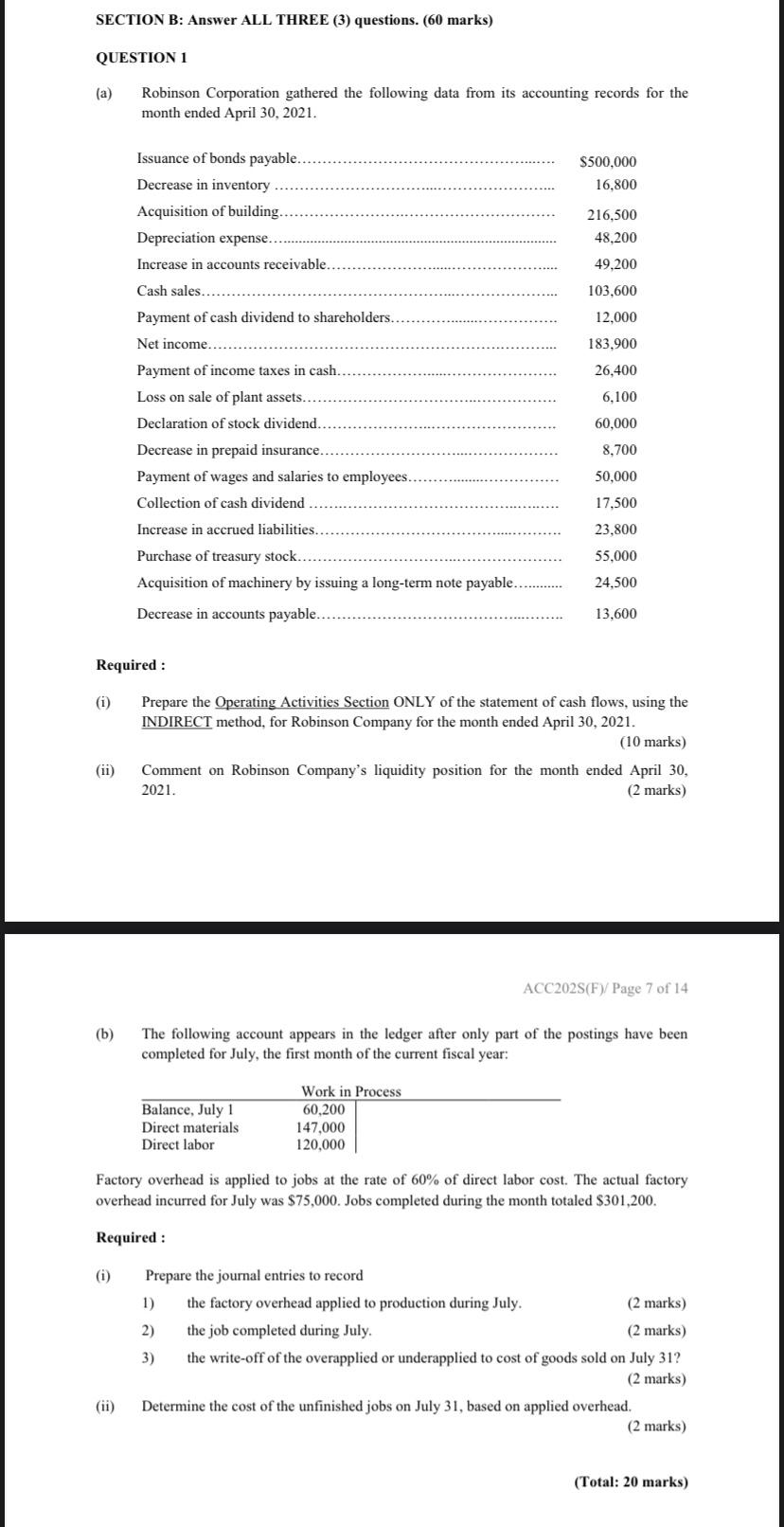

SECTION B: Answer ALL THREE (3) questions. (60 marks) QUESTION 1 (a) Robinson Corporation gathered the following data from its accounting records for the month ended April 30, 2021. $500,000 16,800 Issuance of bonds payable. Decrease in inventory Acquisition of building.. Depreciation expense. Increase in accounts receivable. 216,500 48,200 49,200 Cash sales.. 103,600 Payment of cash dividend to shareholders. 12,000 Net income...... 183,900 26,400 6,100 Payment of income taxes in cash. Loss on sale of plant assets.. Declaration of stock dividend. Decrease in prepaid insurance. Payment of wages and salaries to employees Collection of cash dividend ... 60,000 8,700 50,000 17,500 Increase in accrued liabilities. 23,800 55,000 Purchase of treasury stock. Acquisition of machinery by issuing a long-term note payable. Decrease in accounts payable.. 24.500 13,600 Required: (i) Prepare the Operating Activities Section ONLY of the statement of cash flows, using the INDIRECT method, for Robinson Company for the month ended April 30, 2021. (10 marks) Comment on Robinson Company's liquidity position for the month ended April 30, 2021. (2 marks) (ii) ACC202S(F)/Page 7 of 14 (b) The following account appears in the ledger after only part of the postings have been completed for July, the first month of the current fiscal year: Balance, July 1 Direct materials Direct labor Work in Process 60,200 147,000 120,000 Factory overhead is applied to jobs at the rate of 60% of direct labor cost. The actual factory overhead incurred for July was $75,000. Jobs completed during the month totaled $301,200. Required: (i) Prepare the journal entries to record 1) the factory overhead applied to production during July. (2 marks) 2) the job completed during July. (2 marks) 3) the write-off of the overapplied or underapplied to cost of goods sold on July 31? (2 marks) Determine the cost of the unfinished jobs on July 31, based on applied overhead, (2 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts