Question: Section B - Answer any three questions only. Question 1 Farewell Corp is a company with a debt-to-equity ratio equal to 1. Each share is

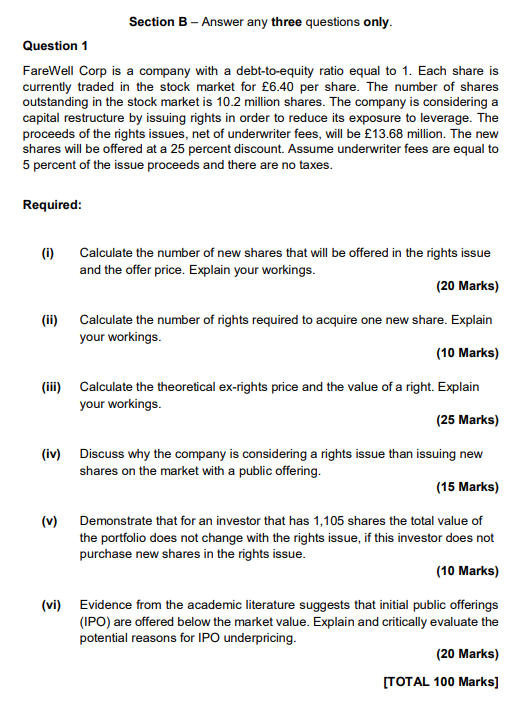

Section B - Answer any three questions only. Question 1 Farewell Corp is a company with a debt-to-equity ratio equal to 1. Each share is currently traded in the stock market for 6.40 per share. The number of shares outstanding in the stock market is 10.2 million shares. The company is considering a capital restructure by issuing rights in order to reduce its exposure to leverage. The proceeds of the rights issues, net of underwriter fees, will be 13.68 million. The new shares will be offered at a 25 percent discount. Assume underwriter fees are equal to 5 percent of the issue proceeds and there are no taxes. Required: (i) Calculate the number of new shares that will be offered in the rights issue and the offer price. Explain your workings. (20 Marks) (ii) Calculate the number of rights required to acquire one new share. Explain your workings. (10 Marks) (iii) Calculate the theoretical ex-rights price and the value of a right. Explain your workings. (25 Marks) (iv) Discuss why the company is considering a rights issue than issuing new shares on the market with a public offering. (15 Marks) (v) Demonstrate that for an investor that has 1,105 shares the total value of the portfolio does not change with the rights issue, if this investor does not purchase new shares in the rights issue. (10 Marks) (vi) Evidence from the academic literature suggests that initial public offerings (IPO) are offered below the market value. Explain and critically evaluate the potential reasons for IPO underpricing. (20 Marks) [TOTAL 100 Marks] Section B - Answer any three questions only. Question 1 Farewell Corp is a company with a debt-to-equity ratio equal to 1. Each share is currently traded in the stock market for 6.40 per share. The number of shares outstanding in the stock market is 10.2 million shares. The company is considering a capital restructure by issuing rights in order to reduce its exposure to leverage. The proceeds of the rights issues, net of underwriter fees, will be 13.68 million. The new shares will be offered at a 25 percent discount. Assume underwriter fees are equal to 5 percent of the issue proceeds and there are no taxes. Required: (i) Calculate the number of new shares that will be offered in the rights issue and the offer price. Explain your workings. (20 Marks) (ii) Calculate the number of rights required to acquire one new share. Explain your workings. (10 Marks) (iii) Calculate the theoretical ex-rights price and the value of a right. Explain your workings. (25 Marks) (iv) Discuss why the company is considering a rights issue than issuing new shares on the market with a public offering. (15 Marks) (v) Demonstrate that for an investor that has 1,105 shares the total value of the portfolio does not change with the rights issue, if this investor does not purchase new shares in the rights issue. (10 Marks) (vi) Evidence from the academic literature suggests that initial public offerings (IPO) are offered below the market value. Explain and critically evaluate the potential reasons for IPO underpricing. (20 Marks) [TOTAL 100 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts