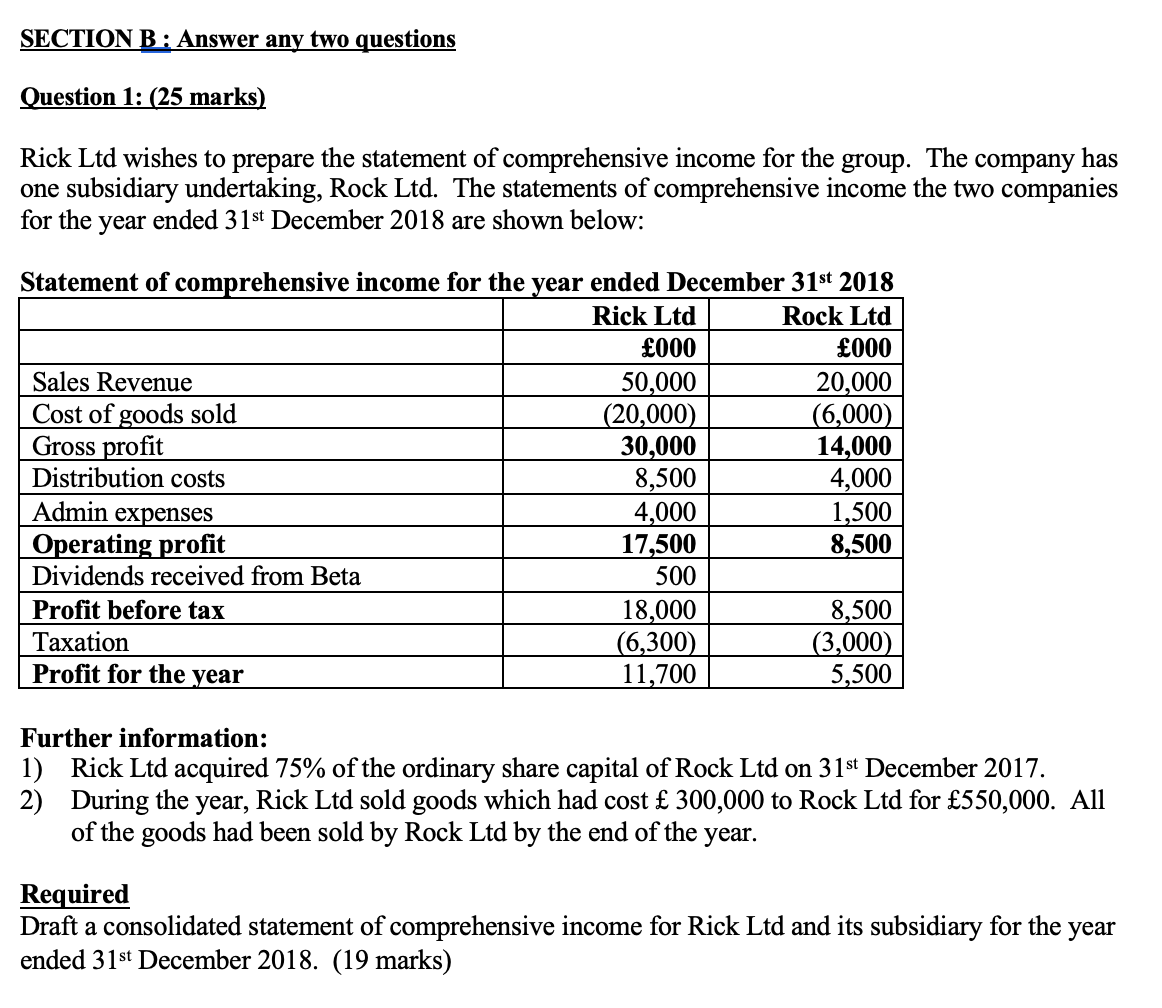

Question: SECTION B : Answer any two questions Question 1: (25 marks) group. The Rick Ltd wishes to prepare the statement of comprehensive income for the

SECTION B : Answer any two questions Question 1: (25 marks) group. The Rick Ltd wishes to prepare the statement of comprehensive income for the company has one subsidiary undertaking, Rock Ltd. The statements of comprehensive income the two companies for the year ended 31st December 2018 are shown below: Statement of comprehensive income for the year ended December 31st 2018 Rick Ltd Rock Ltd 000 000 Sales Revenue 50,000 20,000 Cost of goods sold (20,000) (6,000 Gross profit 30,000 14,000 Distribution costs 8,500 4,000 Admin expenses 4,000 1,500 Operating profit 17,500 8,500 Dividends received from Beta 500 Profit before tax 18,000 8,500 Taxation (6,300) (3,000) Profit for the year 11,700 5,500 Further information: 1) Rick Ltd acquired 75% of the ordinary share capital of Rock Ltd on 31st December 2017. 2) During the year, Rick Ltd sold goods which had cost 300,000 to Rock Ltd for 550,000. All of the goods had been sold by Rock Ltd by the end of the year. Required Draft a consolidated statement of comprehensive income for Rick Ltd and its subsidiary for the year ended 31st December 2018. (19 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts