Question: SECTION B: ANSWER TWO QUESTIONS FROM THIS SECTION Question 3 An international fund invests worldwide in various promising stocks in different sectors. The fund adopts

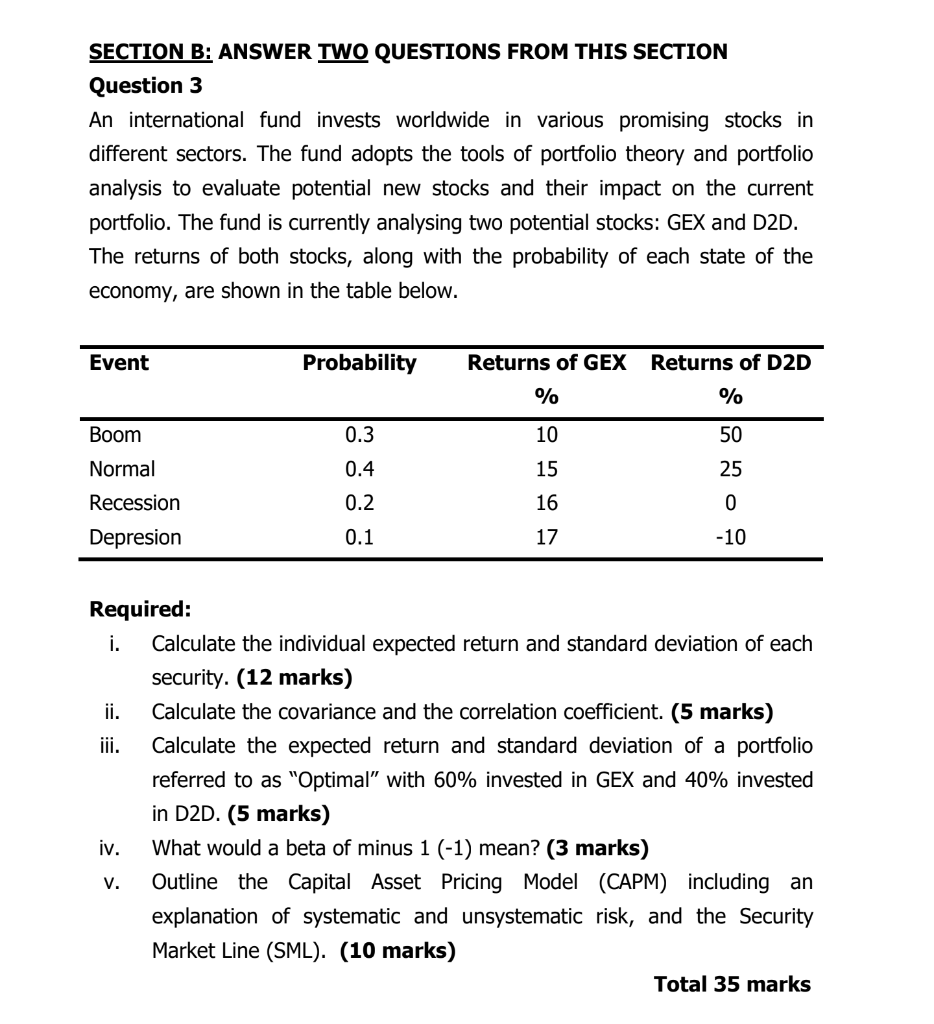

SECTION B: ANSWER TWO QUESTIONS FROM THIS SECTION Question 3 An international fund invests worldwide in various promising stocks in different sectors. The fund adopts the tools of portfolio theory and portfolio analysis to evaluate potential new stocks and their impact on the current portfolio. The fund is currently analysing two potential stocks: GEX and D2D. The returns of both stocks, along with the probability of each state of the economy, are shown in the table below. Event Probability Returns of GEX Returns of D2D % % 0.3 10 50 Boom Normal 0.4 15 25 Recession 0.2 16 0 Depresion 0.1 17 -10 Required: i. Calculate the individual expected return and standard deviation of each security. (12 marks) ii. Calculate the covariance and the correlation coefficient. (5 marks) iii. Calculate the expected return and standard deviation of a portfolio referred to as "Optimal with 60% invested in GEX and 40% invested in D2D. (5 marks) iv. What would a beta of minus 1 (-1) mean? (3 marks) Outline the Capital Asset Pricing Model (CAPM) including an explanation of systematic and unsystematic risk, and the Security Market Line (SML). (10 marks) Total 35 marks V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts