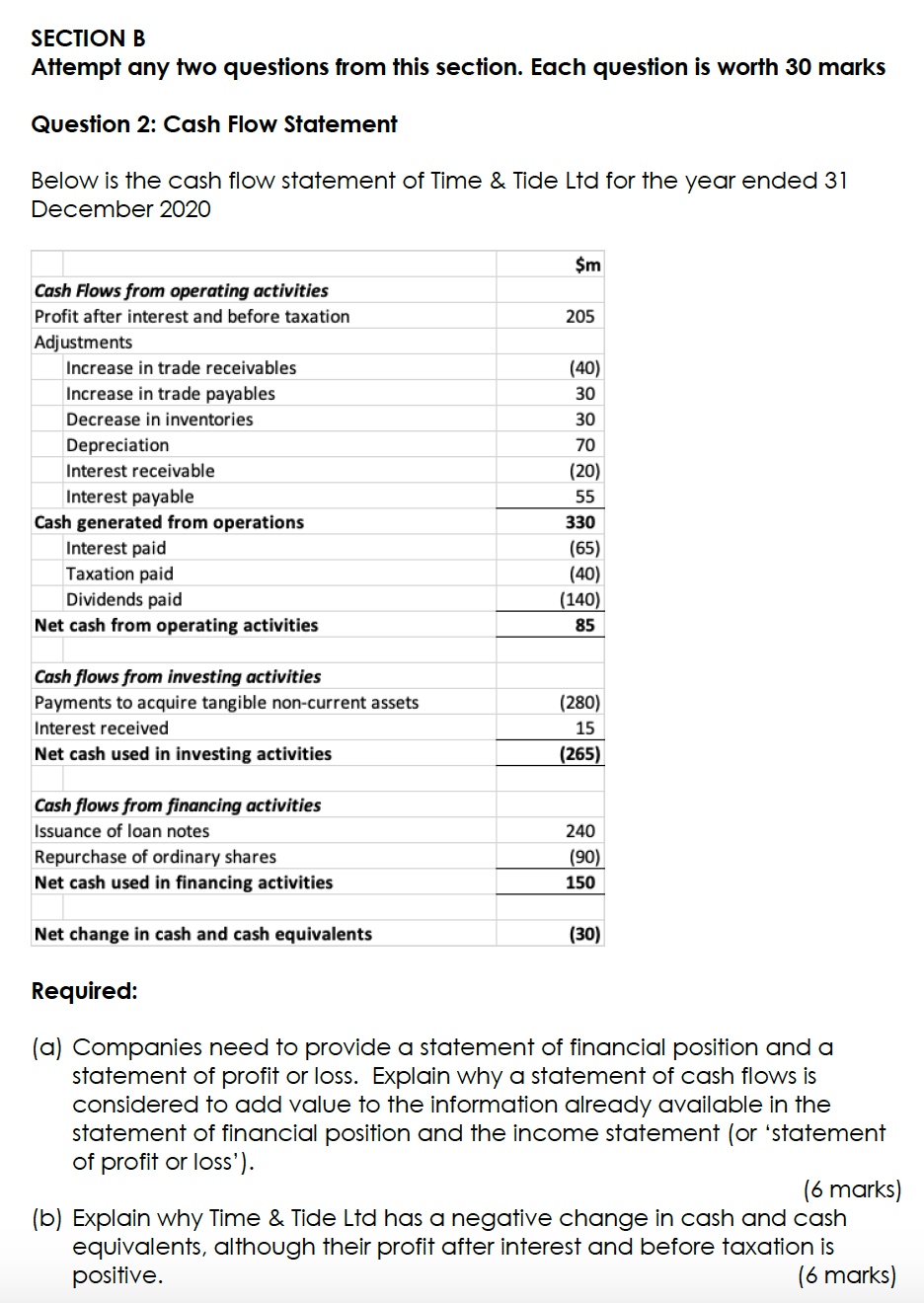

Question: SECTION B Attempt any two questions from this section. Each question is worth 30 marks Question 2: Cash Flow Statement Below is the cash flow

SECTION B Attempt any two questions from this section. Each question is worth 30 marks Question 2: Cash Flow Statement Below is the cash flow statement of Time & Tide Ltd for the year ended 31 December 2020 $m 205 Cash Flows from operating activities Profit after interest and before taxation Adjustments Increase in trade receivables Increase in trade payables Decrease in inventories Depreciation Interest receivable Interest payable Cash generated from operations Interest paid Taxation paid Dividends paid Net cash from operating activities (40) 30 30 70 (20) 55 330 (65) (40) (140) 85 Cash flows from investing activities Payments to acquire tangible non-current assets Interest received Net cash used in investing activities (280) 15 (265) Cash flows from financing activities Issuance of loan notes Repurchase of ordinary shares Net cash used in financing activities 240 (90) 150 Net change in cash and cash equivalents (30) Required: (a) Companies need to provide a statement of financial position and a statement of profit or loss. Explain why a statement of cash flows is considered to add value to the information already available in the statement of financial position and the income statement (or 'statement of profit or loss'). (6 marks) (b) Explain why Time & Tide Ltd has a negative change in cash and cash equivalents, although their profit after interest and before taxation is positive. (6 marks) (c) Is the company using the direct or indirect method for preparing their cash flow statement? Please explain. (3 marks) (d) Depreciation is a non-cash expense. Why is it included in the cash flow statement of Time & Tide Ltd? (3 marks) (e) Discuss the cash flow statement and evaluate the overall cash flow situation of the fiscal year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts