Question: SECTION B Attempt only TWO (2) Ouestions from this Section QUESTION 1 Consider that Adjovi Hevi placed GHS 12,525 in Mutual Fund for the next

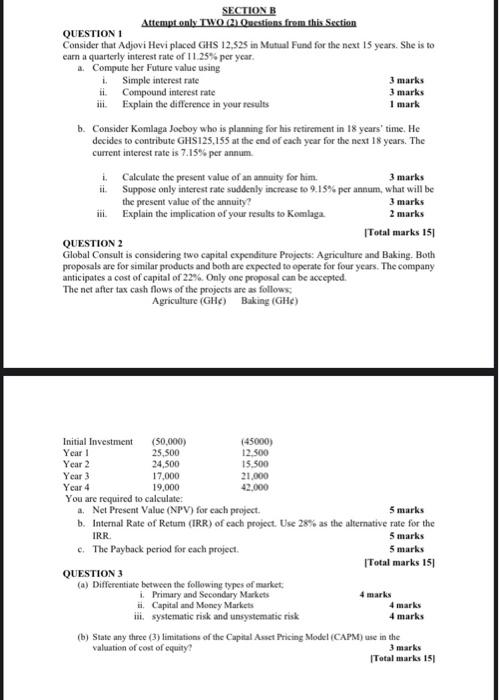

SECTION B Attempt only TWO (2) Ouestions from this Section QUESTION 1 Consider that Adjovi Hevi placed GHS 12,525 in Mutual Fund for the next 15 years. She is to earn a quarterly interest rate of 11.25% per year. a. Compute ber Future valuc using i Simple interest rate 3 marks Compound interest rate 3 marks Explain the difference in your results 1 mark b. Consider Komlaga Jocboy who is planning for his retirement in 18 years" time. He decides to contribute GHS125,155 at the end of each year for the next 18 years. The current interest rate is 7.15% per annum Calculate the present value of an annuity for him. 3 marks ii. Suppose only interest rate suddenly increase to 9.15% per annum, what will be the present value of the annuity? 3 marks Explain the implication of your results to Komlaga 2 marks QUESTION 2 [Total marks 151 Global Consult is considering two capital expenditure Projects: Agriculture and Baking. Both proposals are for similar products and both are expected to operate for four years. The company anticipates a cost of capital of 22%. Only one proposal can be accepted. The net after tax cash flows of the projects are as follows Agriculture (GH) Baking (Ghe) IRR Initial Investment (50,000) (45000) Year 1 25,500 12.500 Year 2 24,500 15.500 Year 3 17,000 21.000 Year 4 19,000 42.000 You are required to calculate: 4. Net Present Value (NPV) for each project 5 marks b. Internal Rate of Retum (IRR) of each project. Use 28% as the alternative rate for the 5 marks c. The Payback period for each project. 5 marks QUESTION 3 Total marks 151 (a) Differentiate between the following types of market i. Primary and Secondary Markets 4 marks Capital and Money Markets 4 marks iii. systematic risk and unsystematic risk 4 marks (b) State any three (3) limitations of the Capital Asset Pricing Model (CAPM) use in the valuation of cost of equity? 3 marks Total marks 151

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts