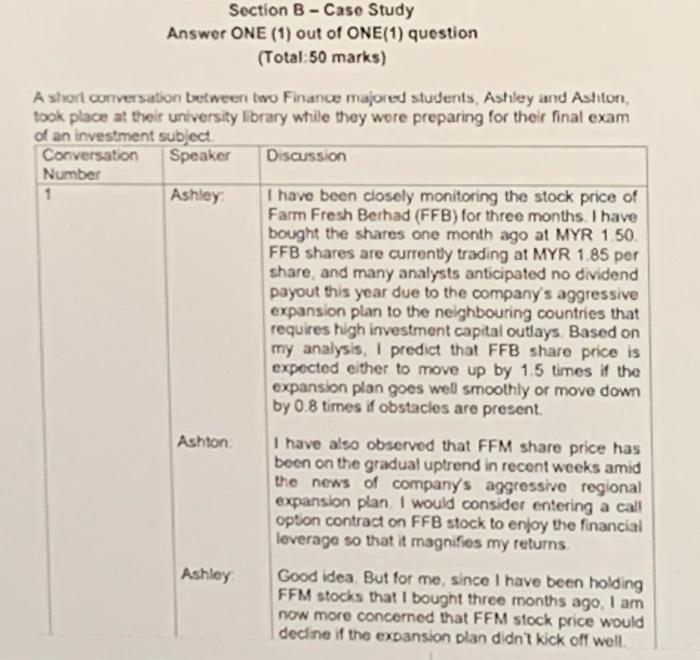

Question: Section B - Case Study Answer ONE (1) out of ONE(1) question (Total: 50 marks) A short comversation between two Finance majored students, Astiley and

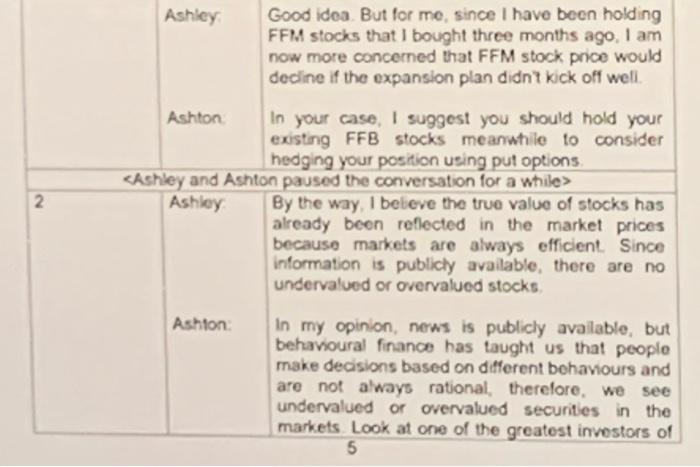

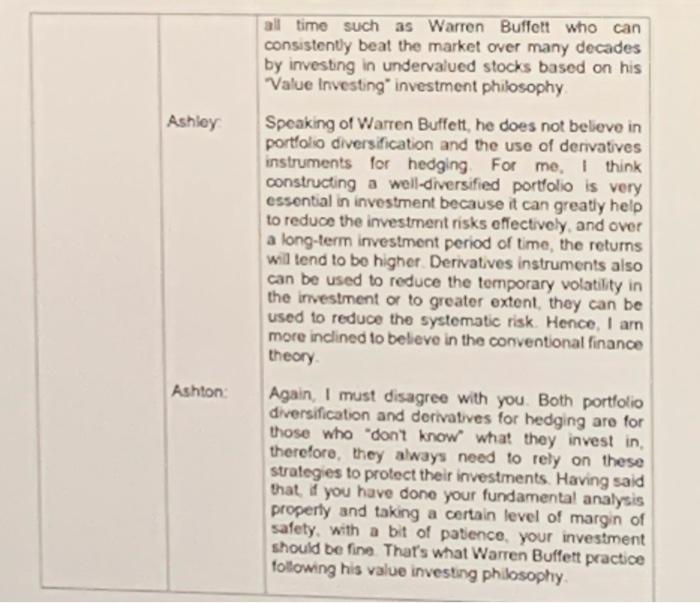

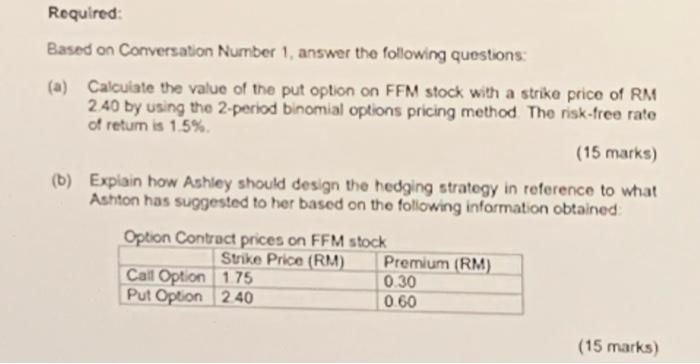

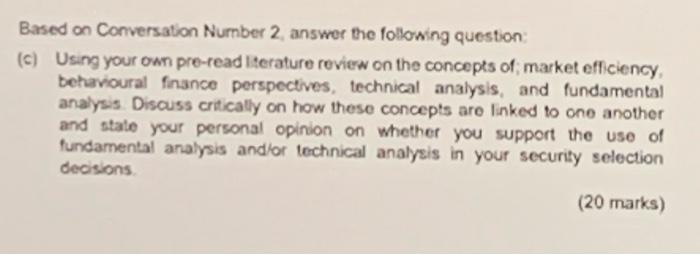

Section B - Case Study Answer ONE (1) out of ONE(1) question (Total: 50 marks) A short comversation between two Finance majored students, Astiley and Ashiton, took place at their university library while they wore preparing for their final exam of an investment subject. all time such as Warren Buffolt who can consistently beat the market over many decades by investing in undervalued stocks based on his "alue Investing" investment philosophy. Required: Based on Conversation Number 1, answer the following questions: (a) Calculate the value of the put option on FFM stock with a strike price of RM 2.40 by using the 2-period binomial options pricing method The risk-free rate of retum is 1.5%. (15 marks) (b) Explain how Ashiey should design the hedging strategy in reference to what Astion has suggested to her based on the following information obtained (15 marks) Based on Conversation Number 2, answer the following question: (c) Using your own pre-read iterature review on the concepts of; market efficiency; behavioural finance perspectives, technical analysis, and fundamental analysis Discuss critically on how these concepts are linked to one another and state your personal opinion on whether you support the use of fundamental analysis andior technical analysis in your security selection decisions. (20 marks) Section B - Case Study Answer ONE (1) out of ONE(1) question (Total: 50 marks) A short comversation between two Finance majored students, Astiley and Ashiton, took place at their university library while they wore preparing for their final exam of an investment subject. all time such as Warren Buffolt who can consistently beat the market over many decades by investing in undervalued stocks based on his "alue Investing" investment philosophy. Required: Based on Conversation Number 1, answer the following questions: (a) Calculate the value of the put option on FFM stock with a strike price of RM 2.40 by using the 2-period binomial options pricing method The risk-free rate of retum is 1.5%. (15 marks) (b) Explain how Ashiey should design the hedging strategy in reference to what Astion has suggested to her based on the following information obtained (15 marks) Based on Conversation Number 2, answer the following question: (c) Using your own pre-read iterature review on the concepts of; market efficiency; behavioural finance perspectives, technical analysis, and fundamental analysis Discuss critically on how these concepts are linked to one another and state your personal opinion on whether you support the use of fundamental analysis andior technical analysis in your security selection decisions. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts