Question: Section B - Consists of two question ,20 Marks Each) (Total 40 Marks) Question 1 Rashid Al Balushi SAOG company is specialized in the manufacturing

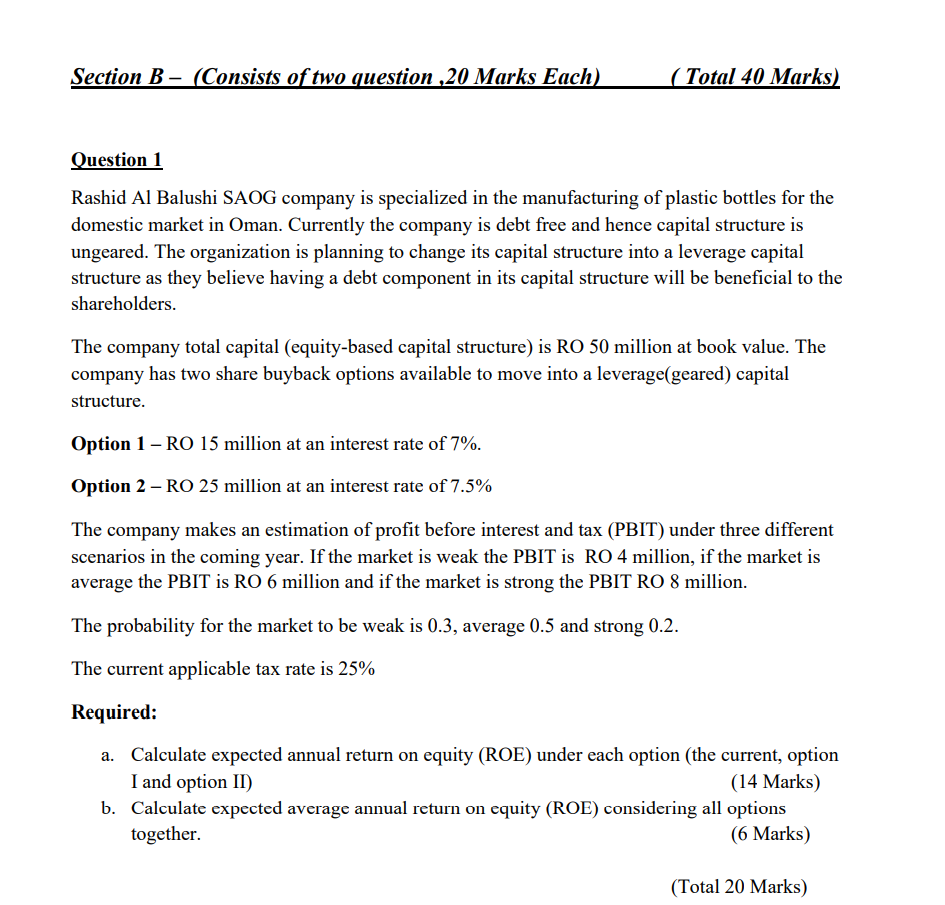

Section B - Consists of two question ,20 Marks Each) (Total 40 Marks) Question 1 Rashid Al Balushi SAOG company is specialized in the manufacturing of plastic bottles for the domestic market in Oman. Currently the company is debt free and hence capital structure is ungeared. The organization is planning to change its capital structure into a leverage capital structure as they believe having a debt component in its capital structure will be beneficial to the shareholders. The company total capital (equity-based capital structure) is RO 50 million at book value. The company has two share buyback options available to move into a leverage(geared) capital structure. Option 1 - RO 15 million at an interest rate of 7%. Option 2 RO 25 million at an interest rate of 7.5% The company makes an estimation of profit before interest and tax (PBIT) under three different scenarios in the coming year. If the market is weak the PBIT is RO 4 million, if the market is average the PBIT is RO6 million and if the market is strong the PBIT RO 8 million. The probability for the market to be weak is 0.3, average 0.5 and strong 0.2. The current applicable tax rate is 25% Required: a. Calculate expected annual return on equity (ROE) under each option (the current, option I and option II) (14 Marks) b. Calculate expected average annual return on equity (ROE) considering all options together. (6 Marks) (Total 20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts