Question: Section B: (each question worth 20 marks. Answer 4 out of 5 questions) Question 1. Parti) Dudley Trudy, CFA, recently met with one of his

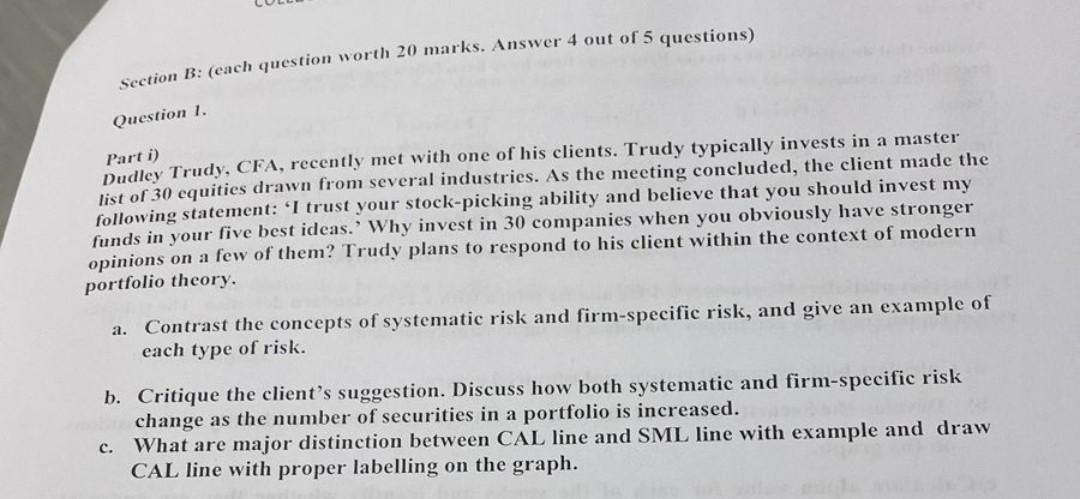

Section B: (each question worth 20 marks. Answer 4 out of 5 questions) Question 1. Parti) Dudley Trudy, CFA, recently met with one of his clients. Trudy typically invests in a master list of 30 equities drawn from several industries. As the meeting concluded, the client made the following statement: 'I trust your stock-picking ability and believe that you should invest my funds in your five best ideas.' Why invest in 30 companies when you obviously have stronger opinions on a few of them? Trudy plans to respond to his client within the context of modern portfolio theory. a. Contrast the concepts of systematic risk and firm-specific risk, and give an example of each type of risk. b. Critique the client's suggestion. Discuss how both systematic and firm-specific risk change as the number of securities in a portfolio is increased. What are major distinction between CAL line and SML line with example and draw CAL line with proper labelling on the graph. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts