Question: Section B: Long Questions (Total 30 marks) Answer ALL questions in this section. Each question carries 15 marks. Question 1 The following table shows the

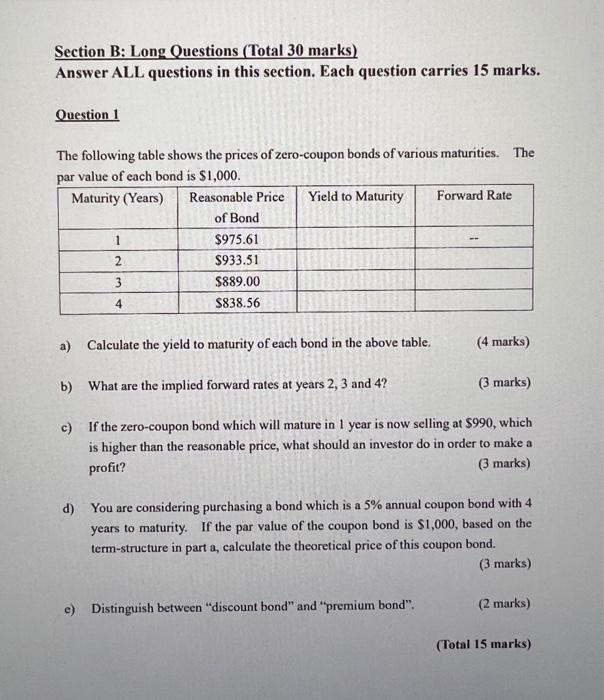

Section B: Long Questions (Total 30 marks) Answer ALL questions in this section. Each question carries 15 marks. Question 1 The following table shows the prices of zero-coupon bonds of various maturities. The par value of each bond is $1,000. Maturity (Years) Reasonable Price Yield to Maturity Forward Rate of Bond 1 2 3 4 $975.61 $933.51 $889.00 $838.56 a) Calculate the yield to maturity of each bond in the above table. b) What are the implied forward rates at years 2, 3 and 4? (4 marks) (3 marks) c) If the zero-coupon bond which will mature in 1 year is now selling at $990, which is higher than the reasonable price, what should an investor do in order to make a profit? (3 marks) e) Distinguish between "discount bond" and "premium bond". d) You are considering purchasing a bond which is a 5% annual coupon bond with 4 years to maturity. If the par value of the coupon bond is $1,000, based on the term-structure in part a, calculate the theoretical price of this coupon bond. (3 marks) (2 marks) (Total 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts