Question: Section B- One question (compulsory) 40 marks weightage 2. Vibrant Constructions commenced business on 1 January 2014 as a Fixed assets. The capital in cash

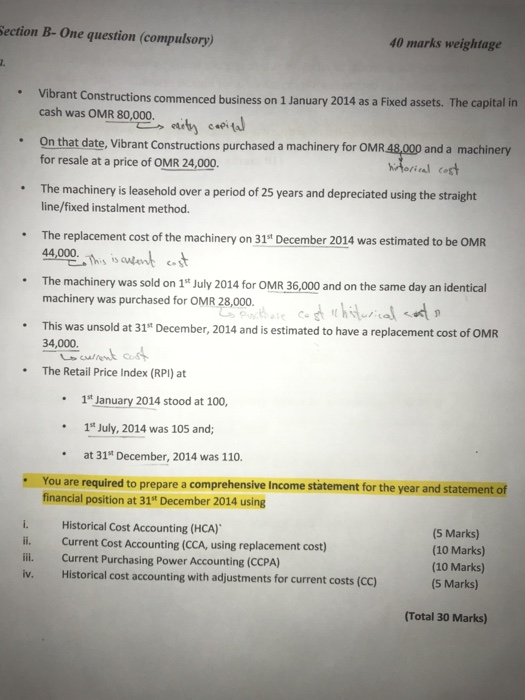

Section B- One question (compulsory) 40 marks weightage 2. Vibrant Constructions commenced business on 1 January 2014 as a Fixed assets. The capital in cash was OMR 80,000. es eity capital On that date, Vibrant Constructions purchased a machinery for OMR 48,000 and a machinery for resale at a price of OMR 24,000. historical cost The machinery is leasehold over a period of 25 years and depreciated using the straight line/fixed instalment method. The replacement cost of the machinery on 31" December 2014 was estimated to be OMR 44,000. This is ouent cost The machinery was sold on 1" July 2014 for OMR 36,000 and on the same day an identical machinery was purchased for OMR 28,000 Mathare cast chiturical cents This was unsold at 31 December, 2014 and is estimated to have a replacement cost of OMR 34,000. to current cast The Retail Price Index (RPI) at 1" January 2014 stood at 100, 1** July, 2014 was 105 and; at 31" December, 2014 was 110. You are required to prepare a comprehensive Income statement for the year and statement of financial position at 31" December 2014 using 1. Historical Cost Accounting (HCA) (5 Marks) Current Cost Accounting (CCA, using replacement cost) (10 Marks) Current Purchasing Power Accounting (CCPA) (10 Marks) Historical cost accounting with adjustments for current costs (CC) (5 Marks) ii. iii. iv. (Total 30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts