Question: SECTION B - Problem Based (11.35am to 12.30pm AND Submission time until 12.40pm) QUESTION 3 K-Fry Bhd. recognised a deferred tax liability for the year

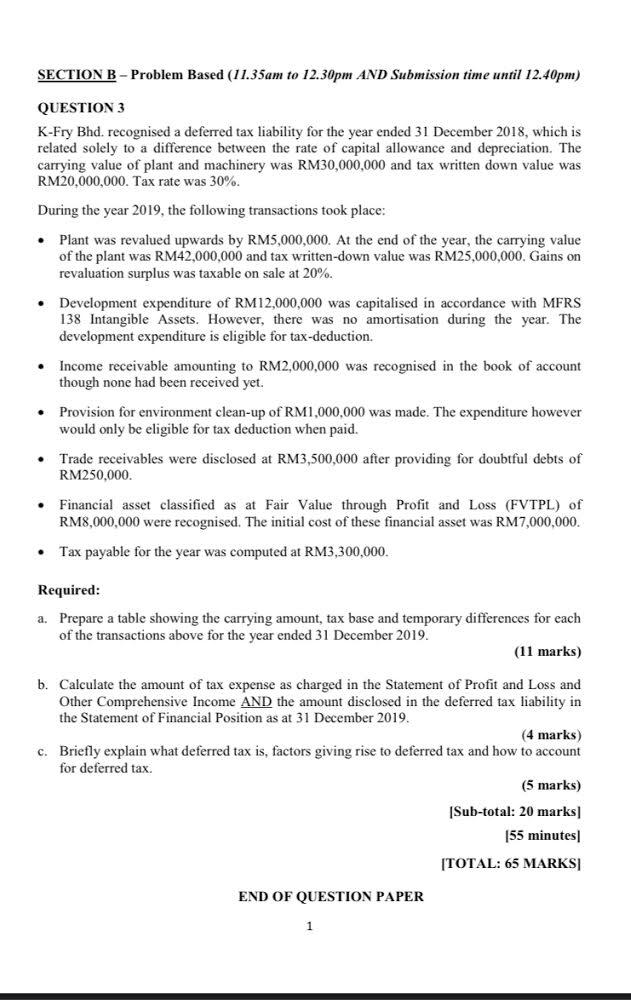

SECTION B - Problem Based (11.35am to 12.30pm AND Submission time until 12.40pm) QUESTION 3 K-Fry Bhd. recognised a deferred tax liability for the year ended 31 December 2018, which is related solely to a difference between the rate of capital allowance and depreciation. The carrying value of plant and machinery was RM30,000,000 and tax written down value was RM20,000,000. Tax rate was 30%. During the year 2019, the following transactions took place: Plant was revalued upwards by RM5,000,000. At the end of the year, the carrying value of the plant was RM42,000,000 and tax written-down value was RM25,000,000. Gains on revaluation surplus was taxable on sale at 20%. Development expenditure of RM12,000,000 was capitalised in accordance with MFRS 138 Intangible Assets. However, there was no amortisation during the year. The development expenditure is eligible for tax-deduction. Income receivable amounting to RM2,000,000 was recognised in the book of account though none had been received yet. Provision for environment clean-up of RM1,000,000 was made. The expenditure however would only be eligible for tax deduction when paid. Trade receivables were disclosed at RM3,500,000 after providing for doubtful debts of RM250,000 Financial asset classified as at Fair Value through Profit and Loss (FVTPL) of RM8,000,000 were recognised. The initial cost of these financial asset was RM7,000,000. Tax payable for the year was computed at RM3,300,000. Required: a. Prepare a table showing the carrying amount, tax base and temporary differences for each of the transactions above for the year ended 31 December 2019. (11 marks) b. Calculate the amount of tax expense as charged in the Statement of Profit and Loss and Other Comprehensive Income AND the amount disclosed in the deferred tax liability in the Statement of Financial Position as at 31 December 2019 (4 marks) c. Briefly explain what deferred tax is, factors giving rise to deferred tax and how to account for deferred tax. (5 marks) Sub-total: 20 marks 155 minutes [TOTAL: 65 MARKSI END OF QUESTION PAPER 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts