Question: Section B: Problem solving You are given the following data about E.Corp, an energy company: - The company's estimated beta is 1.7 - The market

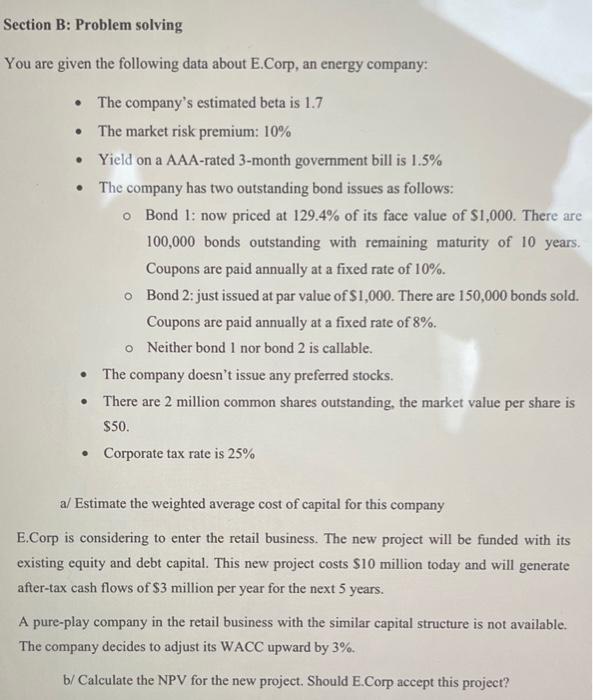

Section B: Problem solving You are given the following data about E.Corp, an energy company: - The company's estimated beta is 1.7 - The market risk premium: 10% - Yield on a AAA-rated 3-month government bill is 1.5\% - The company has two outstanding bond issues as follows: - Bond 1: now priced at 129.4% of its face value of $1,000. There are 100,000 bonds outstanding with remaining maturity of 10 years. Coupons are paid annually at a fixed rate of 10%. - Bond 2: just issued at par value of $1,000. There are 150,000 bonds sold. Coupons are paid annually at a fixed rate of 8%. - Neither bond 1 nor bond 2 is callable. - The company doesn't issue any preferred stocks. - There are 2 million common shares outstanding, the market value per share is $50. - Corporate tax rate is 25% a/ Estimate the weighted average cost of capital for this company E.Corp is considering to enter the retail business. The new project will be funded with its existing equity and debt capital. This new project costs $10 million today and will generate after-tax cash flows of $3 million per year for the next 5 years. A pure-play company in the retail business with the similar capital structure is not available. The company decides to adjust its WACC upward by 3%. b/ Calculate the NPV for the new project. Should E.Corp accept this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts