Question: SECTION B- PROBLEMS (4 problems, total of 80 points) You have prepared the following scenario analysis for the returns of the market index portfolio, M,

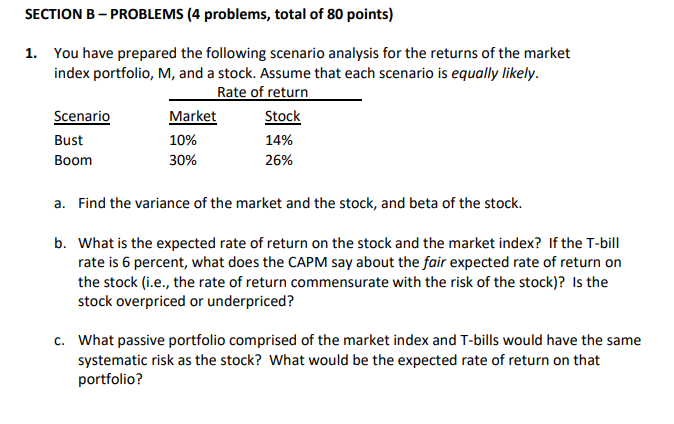

SECTION B- PROBLEMS (4 problems, total of 80 points) You have prepared the following scenario analysis for the returns of the market index portfolio, M, and a stock. Assume that each scenario is equally likely. 1. Rate of return Scenari Bust Boom Market 10% 30% Stock 26% a. Find the variance of the market and the stock, and beta of the stock. b. What is the expected rate of return on the stock and the market index? If the T-bill rate is 6 percent, what does the CAPM say about the fair expected rate of return orn the stock (i.e., the rate of return commensurate with the risk of the stock)? Is the stock overpriced or underpriced? What passive portfolio comprised of the market index and T-bills would have the same systematic risk as the stock? What would be the expected rate of return on that portfolio? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts