Question: SECTION B QUESTION 1: CURRENCY SWAPS Two multinational corporations (MNCs), located in the US and France, both have A- credit rat- ings. The two firms

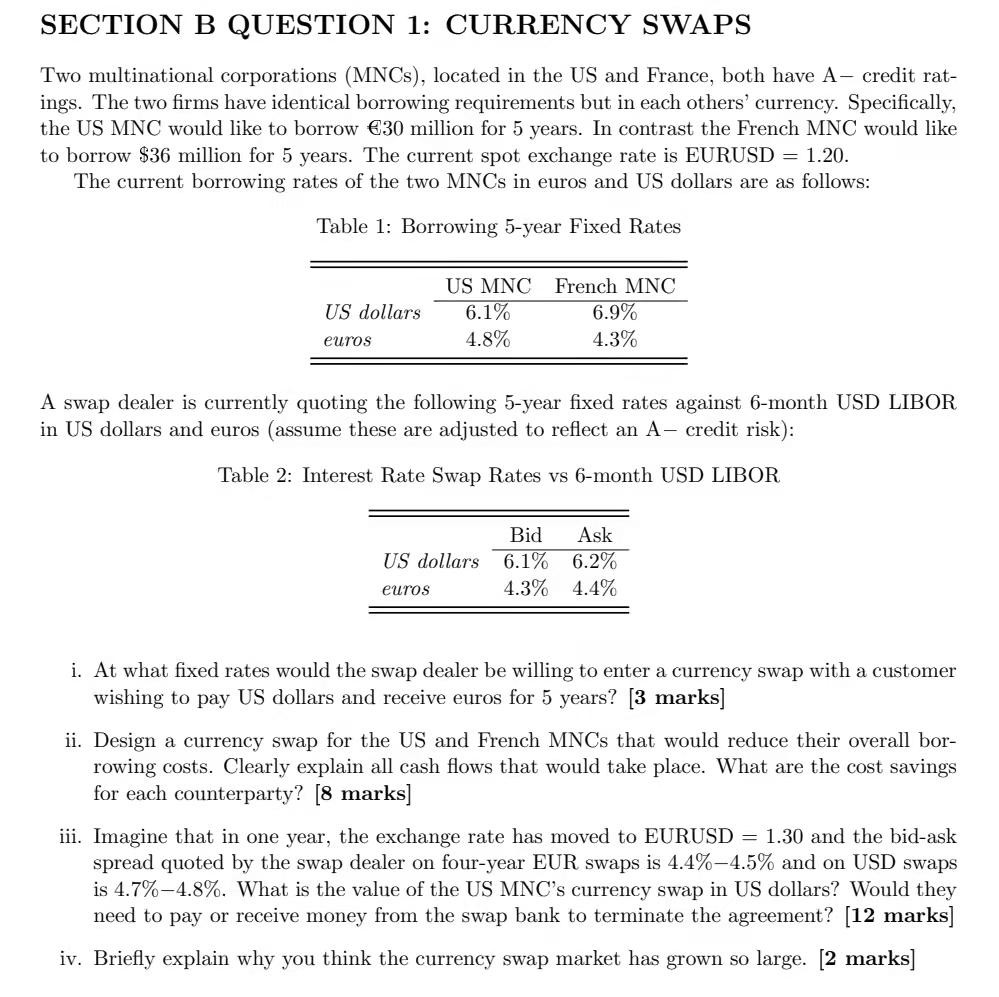

SECTION B QUESTION 1: CURRENCY SWAPS Two multinational corporations (MNCs), located in the US and France, both have A- credit rat- ings. The two firms have identical borrowing requirements but in each others' currency. Specifically, the US MNC would like to borrow 30 million for 5 years. In contrast the French MNC would like to borrow $36 million for 5 years. The current spot exchange rate is EURUSD = 1.20. The current borrowing rates of the two MNCs in euros and US dollars are as follows: Table 1: Borrowing 5-year Fixed Rates US dollars US MNC French MNC 6.1% 6.9% 4.8% 4.3% euros A swap dealer is currently quoting the following 5-year fixed rates against 6-month USD LIBOR in US dollars and euros (assume these are adjusted to reflect an A- credit risk): Table 2: Interest Rate Swap Rates vs 6-month USD LIBOR Bid Ask US dollars 6.1% 6.2% euros 4.3% 4.4% i. At what fixed rates would the swap dealer be willing to enter a currency swap with a customer wishing to pay US dollars and receive euros for 5 years? [3 marks] ii. Design a currency swap for the US and French MNCs that would reduce their overall bor- rowing costs. Clearly explain all cash flows that would take place. What are the cost savings for each counterparty? (8 marks) iii. Imagine that in one year, the exchange rate has moved to EURUSD = 1.30 and the bid-ask spread quoted by the swap dealer on four-year EUR swaps is 4.4%-4.5% and on USD swaps is 4.7%-4.8%. What is the value of the US MNC's currency swap in US dollars? Would they need to pay or receive money from the swap bank to terminate the agreement? (12 marks] iv. Briefly explain why you think the currency swap market has grown so large. [2 marks] SECTION B QUESTION 1: CURRENCY SWAPS Two multinational corporations (MNCs), located in the US and France, both have A- credit rat- ings. The two firms have identical borrowing requirements but in each others' currency. Specifically, the US MNC would like to borrow 30 million for 5 years. In contrast the French MNC would like to borrow $36 million for 5 years. The current spot exchange rate is EURUSD = 1.20. The current borrowing rates of the two MNCs in euros and US dollars are as follows: Table 1: Borrowing 5-year Fixed Rates US dollars US MNC French MNC 6.1% 6.9% 4.8% 4.3% euros A swap dealer is currently quoting the following 5-year fixed rates against 6-month USD LIBOR in US dollars and euros (assume these are adjusted to reflect an A- credit risk): Table 2: Interest Rate Swap Rates vs 6-month USD LIBOR Bid Ask US dollars 6.1% 6.2% euros 4.3% 4.4% i. At what fixed rates would the swap dealer be willing to enter a currency swap with a customer wishing to pay US dollars and receive euros for 5 years? [3 marks] ii. Design a currency swap for the US and French MNCs that would reduce their overall bor- rowing costs. Clearly explain all cash flows that would take place. What are the cost savings for each counterparty? (8 marks) iii. Imagine that in one year, the exchange rate has moved to EURUSD = 1.30 and the bid-ask spread quoted by the swap dealer on four-year EUR swaps is 4.4%-4.5% and on USD swaps is 4.7%-4.8%. What is the value of the US MNC's currency swap in US dollars? Would they need to pay or receive money from the swap bank to terminate the agreement? (12 marks] iv. Briefly explain why you think the currency swap market has grown so large. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts