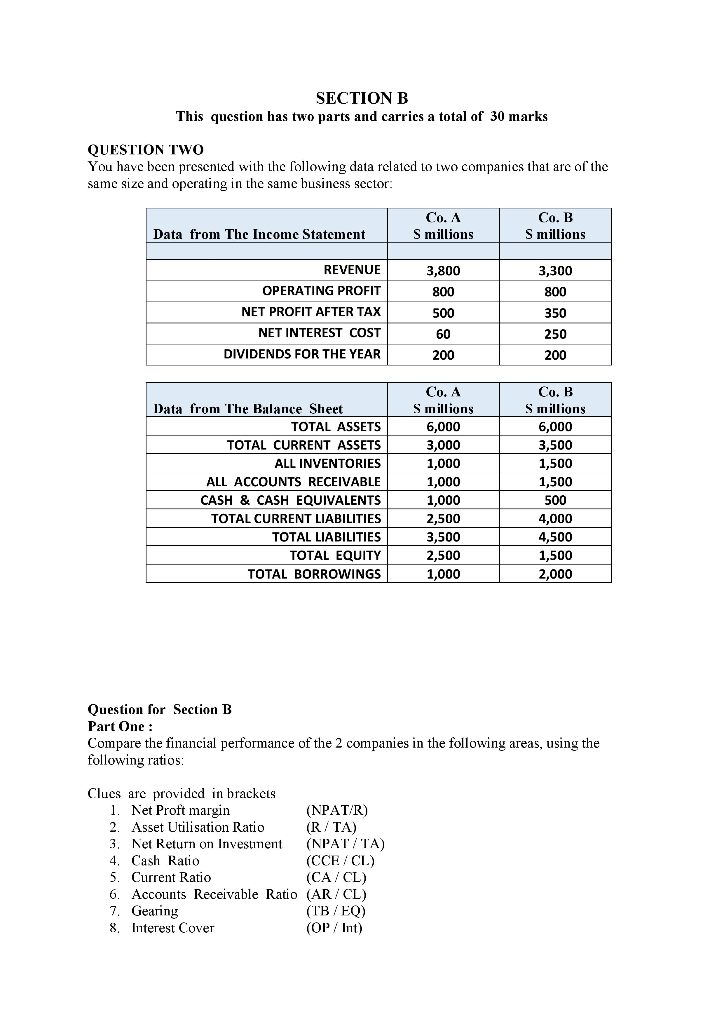

Question: SECTION B This question has two parts and carries a total of 30 marks QUESTION TWO You have been presented with the following data related

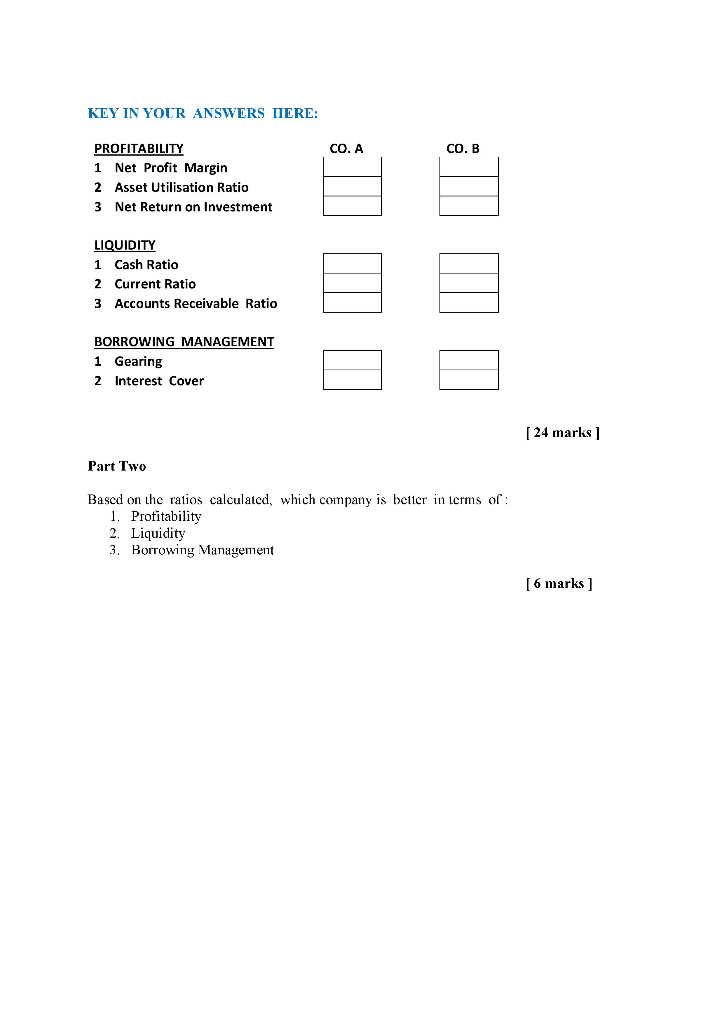

SECTION B This question has two parts and carries a total of 30 marks QUESTION TWO You have been presented with the following data related to Lwo companies that are of the same size and operating in the same business sector: Co. A S millions Co. B S millions Data from The Income Statement REVENUE OPERATING PROFIT NET PROFIT AFTER TAX NET INTEREST COST DIVIDENDS FOR THE YEAR 3,800 800 500 3,300 800 350 250 200 60 200 Data from The Balance Sheet TOTAL ASSETS TOTAL CURRENT ASSETS ALL INVEN ORIES ALL ACCOUNTS RECEIVABLE CASH & CASH EQUIVALENTS TOTAL CURRENT LIABILITIES TOTAL LIABILITIES TOTAL EQUITY TOTAL BORROWINGS Co. A S millions 6,000 3,000 1,000 1,000 1,000 2,500 3,500 2,500 1,000 Co. B S millions 6,000 3,500 1,500 1,500 500 4,000 4,500 1,500 2,000 Question for Section B Part One: Compare the financial performance of the 2 companies in the following areas, using the following ratios: Clues are provided in brackets 1. Net Proft margin (NPAT/R) 2. Asset Utilisation Ratio (R/TA) 3. Net Return on Investiment (NPAT/TA) 4. Cash Ratio (CCE /CL) 5. Current Ratio (CA/CL) 6. Accounts Receivable Ratio (AR/ CL) 7. Gearing (TB/EQ) 8. Interest Cover (OP / Int) KEY IN YOUR ANSWERS HERE: CO. A CO.B PROFITABILITY 1 Net Profit Margin 2 Asset Utilisation Ratio 3 Net Return on Investment LIQUIDITY 1 Cash Ratio 2 Current Ratio 3 Accounts Receivable Ratio BORROWING MANAGEMENT 1 Gearing 2 Interest Cover [ 24 marks] Part Two Based on the ratios calculated, which company is better in terms of: 1. Profitability 2. Liquidity 3. Borrowing Management [6 marks ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts