Question: SECTION B This Section consists of TWO questions. Answer ONE question only. QUESTION THREE You have analysed the risk factors in order to calculate the

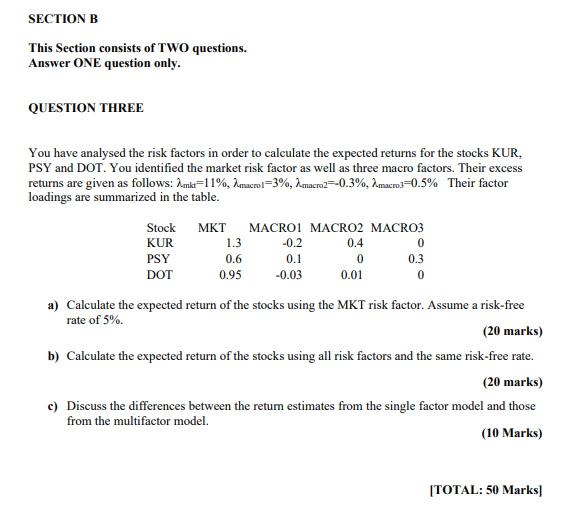

SECTION B This Section consists of TWO questions. Answer ONE question only. QUESTION THREE You have analysed the risk factors in order to calculate the expected returns for the stocks KUR, PSY and DOT. You identified the market risk factor as well as three macro factors. Their excess returns are given as follows: Amk=11%, Amacrol=3%, Amacro2=-0.3%, Amacro3=0.5% Their factor loadings are summarized in the table. Stock KUR PSY DOT MKT 1.3 0.6 MACROI MACRO2 MACRO3 -0.2 0.4 0 0.1 0 -0.03 0.01 0 0.3 0.95 a) Calculate the expected return of the stocks using the MKT risk factor. Assume a risk-free rate of 5%. (20 marks) b) Calculate the expected return of the stocks using all risk factors and the same risk-free rate. (20 marks) c) Discuss the differences between the retum estimates from the single factor model and those from the multifactor model. (10 Marks) [TOTAL: 50 Marks SECTION B This Section consists of TWO questions. Answer ONE question only. QUESTION THREE You have analysed the risk factors in order to calculate the expected returns for the stocks KUR, PSY and DOT. You identified the market risk factor as well as three macro factors. Their excess returns are given as follows: Amk=11%, Amacrol=3%, Amacro2=-0.3%, Amacro3=0.5% Their factor loadings are summarized in the table. Stock KUR PSY DOT MKT 1.3 0.6 MACROI MACRO2 MACRO3 -0.2 0.4 0 0.1 0 -0.03 0.01 0 0.3 0.95 a) Calculate the expected return of the stocks using the MKT risk factor. Assume a risk-free rate of 5%. (20 marks) b) Calculate the expected return of the stocks using all risk factors and the same risk-free rate. (20 marks) c) Discuss the differences between the retum estimates from the single factor model and those from the multifactor model. (10 Marks) [TOTAL: 50 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts