Question: SECTION B. (Total 60 marks) Attempt all questions Question 5 a) What are the main characteristics of Commercial Banks? (5 marks) b) Primary Investments is

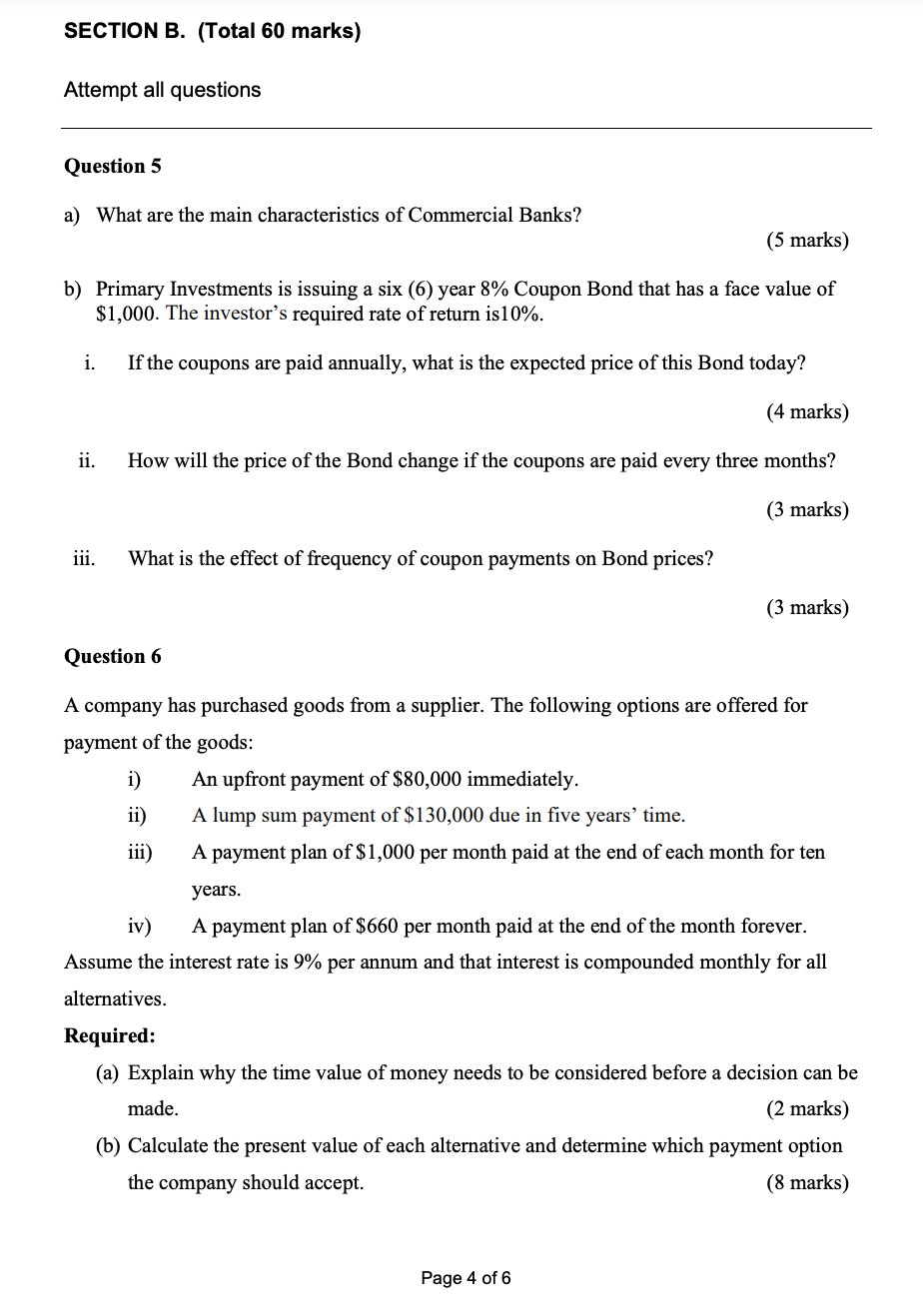

SECTION B. (Total 60 marks) Attempt all questions Question 5 a) What are the main characteristics of Commercial Banks? (5 marks) b) Primary Investments is issuing a six (6) year 8% Coupon Bond that has a face value of $1,000. The investor's required rate of return is 10%. i. If the coupons are paid annually, what is the expected price of this Bond today? (4 marks) ii. How will the pri of the Bond change if the coupons paid every three months? (3 marks) iii. What is the effect of frequency of coupon payments on Bond prices? (3 marks) Question 6 A company has purchased goods from a supplier. The following options are offered for payment of the goods: i) An upfront payment of $80,000 immediately. ii) A lump sum payment of $130,000 due in five years' time. iii) A payment plan of $1,000 per month paid at the end of each month for ten years. iv) A payment plan of $660 per month paid at the end of the month forever. Assume the interest rate is 9% per annum and that interest is compounded monthly for all alternatives. Required: (a) Explain why the time value of money needs to be considered before a decision can be made. (2 marks) (b) Calculate the present value of each alternative and determine which payment option the company should accept. (8 marks) Page 4 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts