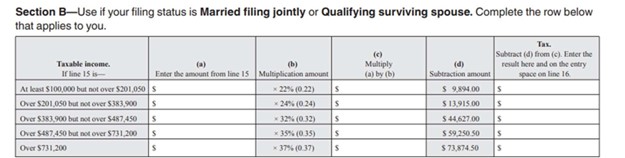

Question: Section B - Use if your filing status is Married filing jointly or Qualifying surviving spouse. Complete the row below that applies to you. Tavable

Section BUse if your filing status is Married filing jointly or Qualifying surviving spouse. Complete the row below that applies to you. Tavable income. If line isa Erter the amount from line b Multiplication amount c Multiply a by bd Subtraction amount Tax. Subtract d from c Enter the recult here and oe the cetry space on line The following tables was taken from the Federal form Instructions Based on the preceding information, recalculate the Column d Subtraction amount of $ Show your work. Schedule YII your filing status is Married filing jointly or Qualifying surviving spouseIf your taxable income is:But not overof the amount over

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock