Question: Section C Value - added Tax and Journals 2 5 Marks Question 3 Study the scenario and complete the questions that follow: Stoneridge Traders Stoneridge

Section C

Valueadded Tax and Journals

Marks

Question

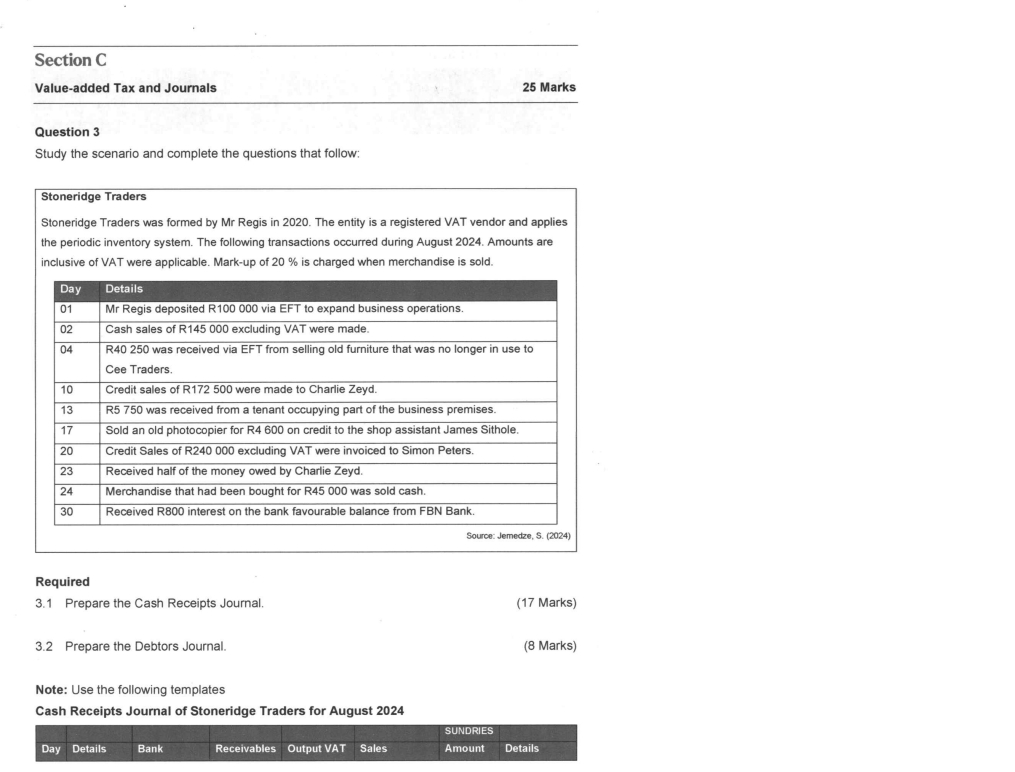

Study the scenario and complete the questions that follow:

Stoneridge Traders

Stoneridge Traders was formed by Mr Regis in The entity is a registered VAT vendor and applies the periodic inventory system. The following transactions occurred during August Amounts are inclusive of VAT were applicable. Markup of is charged when merchandise is sold.

begintabularll

hline Day & Details

hline & Mr Regis deposited R via EFT to expand business operations.

hline & begintabularl

Rash sales of R excluding VAT were made.

Cee Traders.

endtabular

hline & Credit sales of R were made to Charlie Zeyd.

hline & R was received from a tenant occupying part of the business premises.

hline & Sold an old photocopier for R on credit to the shop assistant James Sithole.

hline & Credit Sales of R excluding VAT were invoiced to Simon Petling old furniture that was no longer in use to

hline & Received half of the money owed by Charlie Zeyd.

hline & Merchandise that had been bought for R was sold cash.

hline & Received R interest on the bank favourable balance from FBN Bank.

hline &

endtabular

Source: Jemedze, S

Required

Prepare the Cash Receipts Journal.

Marks

Prepare the Debtors Journal.

Marks

Note: Use the following templates

Cash Receipts Journal of Stoneridge Traders for August

begintabularllllllll

hline Day & Details & Bank & Receivables & Output VAT & Sales & Amount & Details

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock