Question: SECTION D: THE PROBLEM ACTIVITY (30 Marks) BANK ASSETS Cash Treasury Bills & Bonds Repos Municipal Securities Family 1 - 4 Residential Mortgage Commercial &

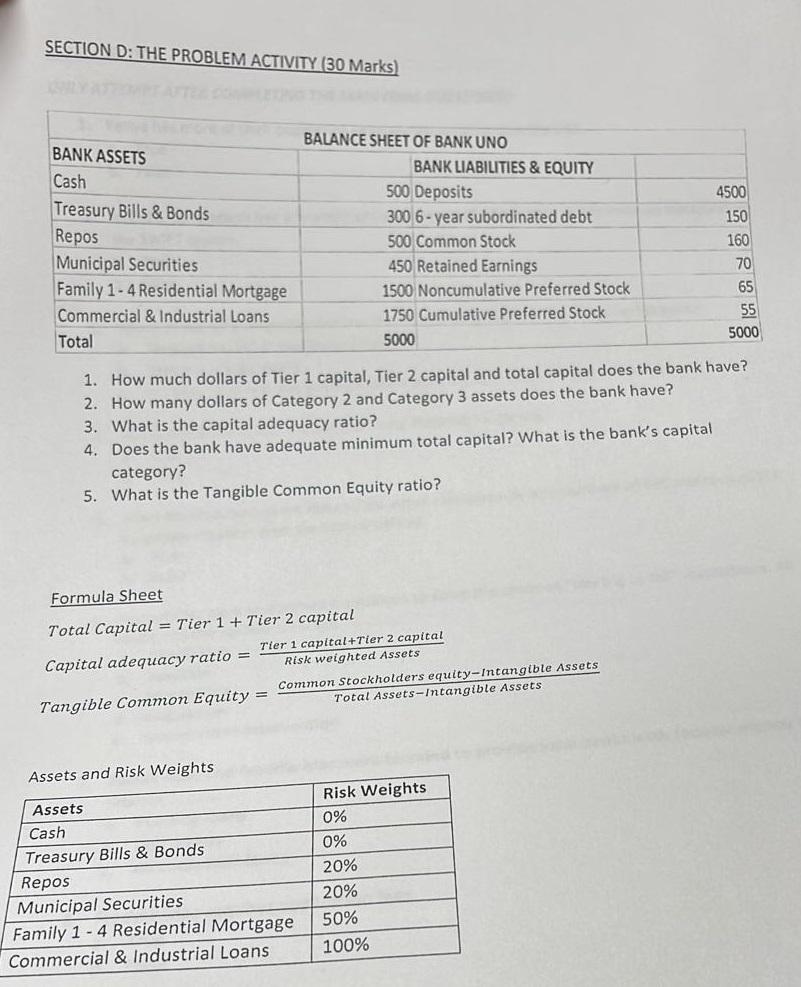

SECTION D: THE PROBLEM ACTIVITY (30 Marks) BANK ASSETS Cash Treasury Bills & Bonds Repos Municipal Securities Family 1 - 4 Residential Mortgage Commercial & Industrial Loans Total BALANCE SHEET OF BANK UNO BANK LIABILITIES & EQUITY 500 Deposits 300 6-year subordinated debt 500 Common Stock 450 Retained Earnings 1500 Noncumulative Preferred Stock 1750 Cumulative Preferred Stock 5000 4500 150 160 70 65 55 5000 1. How much dollars of Tier 1 capital, Tier 2 capital and total capital does the bank have? 2. How many dollars of Category 2 and Category 3 assets does the bank have? 3. What is the capital adequacy ratio? 4. Does the bank have adequate minimum total capital? What is the bank's capital category? 5. What is the Tangible Common Equity ratio? Formula Sheet Total Capital = Tier 1 + Tier 2 capital Capital adequacy ratio = Tier 1 capital+Tier 2 capital Risk weighted Assets Tangible Common Equity = Common Stockholders equity-Intangible Assets Total Assets-Intangible Assets Assets and Risk Weights Assets Cash Treasury Bills & Bonds Repos Municipal Securities Family 1 - 4 Residential Mortgage Commercial & Industrial Loans Risk Weights 0% 0% 20% 20% 50% 100% SECTION D: THE PROBLEM ACTIVITY (30 Marks) BANK ASSETS Cash Treasury Bills & Bonds Repos Municipal Securities Family 1 - 4 Residential Mortgage Commercial & Industrial Loans Total BALANCE SHEET OF BANK UNO BANK LIABILITIES & EQUITY 500 Deposits 300 6-year subordinated debt 500 Common Stock 450 Retained Earnings 1500 Noncumulative Preferred Stock 1750 Cumulative Preferred Stock 5000 4500 150 160 70 65 55 5000 1. How much dollars of Tier 1 capital, Tier 2 capital and total capital does the bank have? 2. How many dollars of Category 2 and Category 3 assets does the bank have? 3. What is the capital adequacy ratio? 4. Does the bank have adequate minimum total capital? What is the bank's capital category? 5. What is the Tangible Common Equity ratio? Formula Sheet Total Capital = Tier 1 + Tier 2 capital Capital adequacy ratio = Tier 1 capital+Tier 2 capital Risk weighted Assets Tangible Common Equity = Common Stockholders equity-Intangible Assets Total Assets-Intangible Assets Assets and Risk Weights Assets Cash Treasury Bills & Bonds Repos Municipal Securities Family 1 - 4 Residential Mortgage Commercial & Industrial Loans Risk Weights 0% 0% 20% 20% 50% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts