Question: Section I (20 marks) Multiple Choice Questions Answer ALL questions in this section. One mark for each question. Choose the best answer. Provide your answers

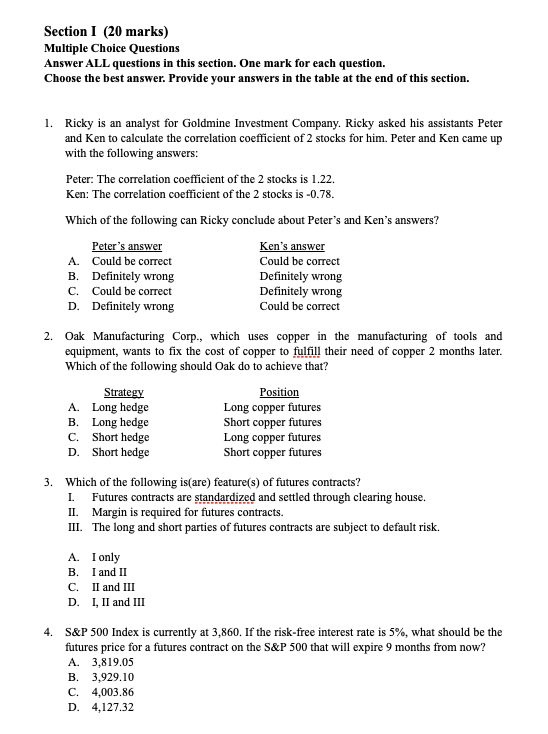

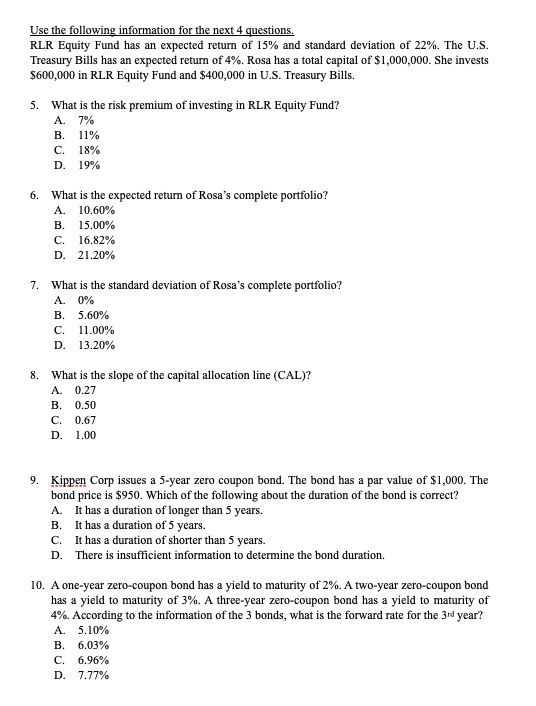

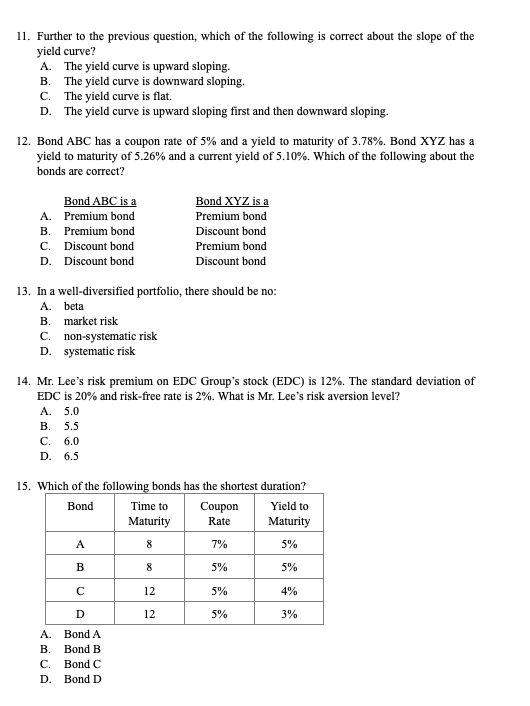

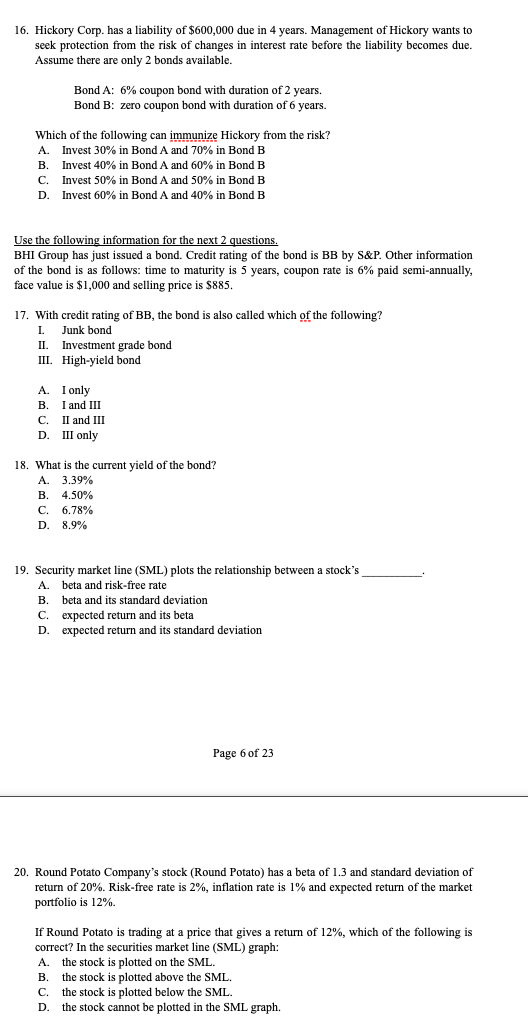

Section I (20 marks) Multiple Choice Questions Answer ALL questions in this section. One mark for each question. Choose the best answer. Provide your answers in the table at the end of this section. 1. Ricky is an analyst for Goldmine Investment Company. Ricky asked his assistants Peter and Ken to calculate the correlation coefficient of 2 stocks for him. Peter and Ken came up with the following answers: Peter: The correlation coefficient of the 2 stocks is 1.22. Ken: The correlation coefficient of the 2 stocks is -0.78. Which of the following can Ricky conclude about Peter's and Ken's answers? Peter's answer Ken's answer A. Could be correct Could be correct B. Definitely wrong Definitely wrong C. Could be correct Definitely wrong D. Definitely wrong Could be correct 2. Oak Manufacturing Corp., which uses copper in the manufacturing of tools and equipment, wants to fix the cost of copper to fulfill their need of copper 2 months later. Which of the following should Oak do to achieve that? Strategy Position A. Long hedge Long copper futures B. Long hedge Short copper futures C. Short hedge Long copper futures D. Short hedge Short copper futures 3. Which of the following isare) feature(s) of futures contracts? I Futures contracts are standardized and settled through clearing house. 11. Margin is required for futures contracts. III. The long and short parties of futures contracts are subject to default risk. A. I only B. I and II C. II and III D. I, II and III 4. S&P 500 Index is currently at 3,860. If the risk-free interest rate is 5%, what should be the futures price for a futures contract on the S&P 500 that will expire 9 months from now? A. 3,819.05 B. 3,929.10 C. 4.003.86 D. 4,127.32 Use the following information for the next 4 questions. RLR Equity Fund has an expected return of 15% and standard deviation of 22%. The U.S. Treasury Bills has an expected return of 4%. Rosa has a total capital of $1,000,000. She invests $600,000 in RLR Equity Fund and $400,000 in U.S. Treasury Bills, 5. What is the risk premium of investing in RLR Equity Fund? A. 7% B. 11% c. 18% 19% D. 6. What is the expected return of Rosa's complete portfolio? A. 10.60% B. 15.00% C. 16.82% D. 21.20% 7. What is the standard deviation of Rosa's complete portfolio? A 0% B. 5.60% C. 11.00% D. 13.20% 8. What is the slope of the capital allocation line (CAL)? A. 0.27 B. 0.50 C. 0.67 D. 1.00 9. Kippen Corp issues a 5-year zero coupon bond. The bond has a par value of $1,000. The bond price is $950. Which of the following about the duration of the bond is correct? A. It has a duration of longer than 5 years. B. It has a duration of 5 years. C. It has a duration of shorter than 5 years. D. There is insufficient information to determine the bond duration. 10. A one-year zero-coupon bond has a yield to maturity of 2%. A two-year zero-coupon bond has a yield to maturity of 3%. A three-year zero-coupon bond has a yield to maturity of 4%. According to the information of the 3 bonds, what is the forward rate for the 3rd year? A. 5.10% B. 6.03% C. 6.96% D. 7.77% 11. Further to the previous question, which of the following is correct about the slope of the yield curve? A. The yield curve is upward sloping. B. The yield curve is downward sloping. C. The yield curve is flat. D. The yield curve is upward sloping first and then downward sloping. 12. Bond ABC has a coupon rate of 5% and a yield to maturity of 3.78%. Bond XYZ has a yield to maturity of 5.26% and a current yield of 5.10%. Which of the following about the bonds are correct? Bond ABC is a A. Premium bond B. Premium bond C. Discount bond D. Discount bond Bond XYZ is a Premium bond Discount bond Premium bond Discount bond 13. In a well-diversified portfolio, there should be no: A. beta B. market risk c. non-systematic risk D. Systematic risk 14. Mr. Lee's risk premium on EDC Group's stock (EDC) is 12%. The standard deviation of EDC is 20% and risk-free rate is 2%. What is Mr. Lee's risk aversion level? A 5.0 B. 5.5 C. 6.0 D. 6.5 15. Which of the following bonds has the shortest duration? Bond Time to Coupon Yield to Maturity Rate Maturity A 8 7% 5% B 8 5% 5% 12 5% 4% D 12 5% 3% MUA A. Bond A Bond B Bond C D. Bond D 16. Hickory Corp. has a liability of $600,000 due in 4 years. Management of Hickory wants to seek protection from the risk of changes in interest rate before the liability becomes due. Assume there are only 2 bonds available. Bond A: 6% coupon bond with duration of 2 years. Bond B: zero coupon bond with duration of 6 years. Which of the following can immunize Hickory from the risk? A. Invest 30% in Bond A and 70% in Bond B B. Invest 40% in Bond A and 60% in Bond B C. Invest 50% in Bond A and 50% in Bond B D. Invest 60% in Bond A and 40% in Bond B Use the following information for the next 2 questions. BHI Group has just issued a bond. Credit rating of the bond is BB by S&P. Other information of the bond is as follows: time to maturity is 5 years, coupon rate is 6% paid semi-annually, face value is $1,000 and selling price is $885. 17. With credit rating of BB, the bond is also called which of the following? I. Junk bond II. Investment grade bond III. High-yield bond A. I only B. I and III C. II and III D. III only 18. What is the current yield of the bond? A. 3.39% B. 4.50% C. 6.78% D. 8.9% 19. Security market line (SML) plots the relationship between a stock's A. beta and risk-free rate B. beta and its standard deviation C. expected return and its beta D. expected return and its standard deviation Page 6 of 23 20. Round Potato Company's stock (Round Potato) has a beta of 1.3 and standard deviation of return of 20%. Risk-free rate is 2%, inflation rate is 1% and expected return of the market portfolio is 12% If Round Potato is trading at a price that gives a return of 12%, which of the following is correct? In the securities market line (SML) graph: A. the stock is plotted on the SML. B the stock is plotted above the SML. c. the stock is plotted below the SML. D. the stock cannot be plotted in the SML graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts