Question: Section I: Problem Solving- Multiple Choice (Maximum Points-30) Note: Circle the letter corresponding to your choice of answer. Circle only gns later for ch question:

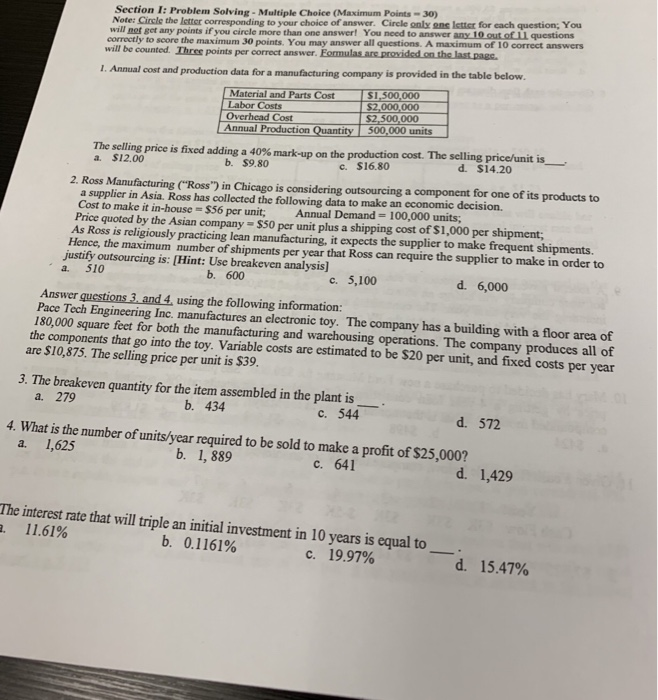

Section I: Problem Solving- Multiple Choice (Maximum Points-30) Note: Circle the letter corresponding to your choice of answer. Circle only gns later for ch question: You will not get any points if you cirele more than one answer! You need to answer correctly to score the maximum 30 points. You may answer all questions. A maximum of 10 correct answers will be counted. Three points per correct answer. Formulas are provided on the last page any 10qut of Ll questions Annual cost and production data for a manufacturing company is provided in the table below. Material and Parts Cost Labor Costs Overhead Cost $1,500,000 $2,000,000 $2,500,000 Annual Production Quantity 500,000 units The selling price is fixed adding a40% mark-up on the production b. $9.80 ost. The selling price/unit is a. $12.00 c. $16.80 d. $14.20 2. Ross Manufacturing ("Ross") in Chicago is considering outsourcing a component for one of its products to a supplier in Asia. Ross has collected the following data to make an economic decision. Cost to make it in-house $56 per unit; Annual Demand-100,000 units; Price quoted by the Asian company $50 per unit plus a shipping cost of $1,000 per shipment; As Ross is religiously practicing lean manufacturing, it expects the supplier to make frequent shipments. Hence, the maximum number of shipments per year that Ross can require the supplier to make in order to justify outsourcing is: [Hint: Use breakeven analysis] a. 510 b. 600 c. 5,100 d. 6,000 Answer questions 3 and 4 using the following information: Pace Tech Engineering Inc. manufactures an electronic toy. The company has a building with a floor area of 180,000 square feet for both the manufacturing and warchousing operations. The company produces all of the components that go into the toy. Variable costs are estimated to be $20 per unit, and fixed costs per year are $10,875. The selling price per unit is $39 3. The breakeven quantity for the item assembled in the plant is a. 279 b. 434 4. What is the number of units/year required to be sold to make a profit of b. 1, 889 c. 544 d. 572 a. 1,625 c. 641 d. 1,429 The interest rate that will triple an initial investment in 10 years is equal to 0.1161% 11.61% b. c. 19.97% d. 15.47%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts