Question: Section II. Multiple-choice Questions (20 points -- 4 points each) For each of the following questions select one and only one choice (A, B, C,

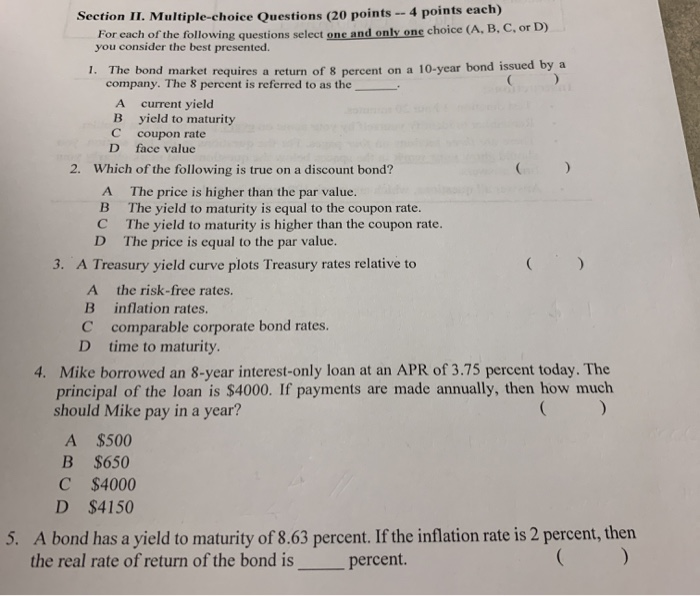

Section II. Multiple-choice Questions (20 points -- 4 points each) For each of the following questions select one and only one choice (A, B, C, or D) you consider the best presented. 1. The bond market requires a return of 8 percent on a 10-year bond issued by a company. The 8 percent is referred to as the A current yield B yield to maturity C coupon rate D face value 2. Which of the following is true on a discount bond? A The price is higher than the par value. B The yield to maturity is equal to the coupon rate. C The yield to maturity is higher than the coupon rate. D The price is equal to the par value. 3. A Treasury yield curve plots Treasury rates relative to A the risk-free rates. B inflation rates. C comparable corporate bond rates. D time to maturity 4. Mike borrowed an 8-year interest-only loan at an APR of 3.75 percent today. The principal of the loan is $4000. If payments are made annually, then how much should Mike pay in a year? A $500 B $650 C $4000 D $4150 5. A bond has a yield to maturity of 8.63 percent. If the inflation rate is 2 percent, then the real rate of return of the bond is percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts