Question: Section IV. Financial Ratios - Calculation & Interpretation Six months has now past, and Marine has experienced continued growth and expansion which has attracted the

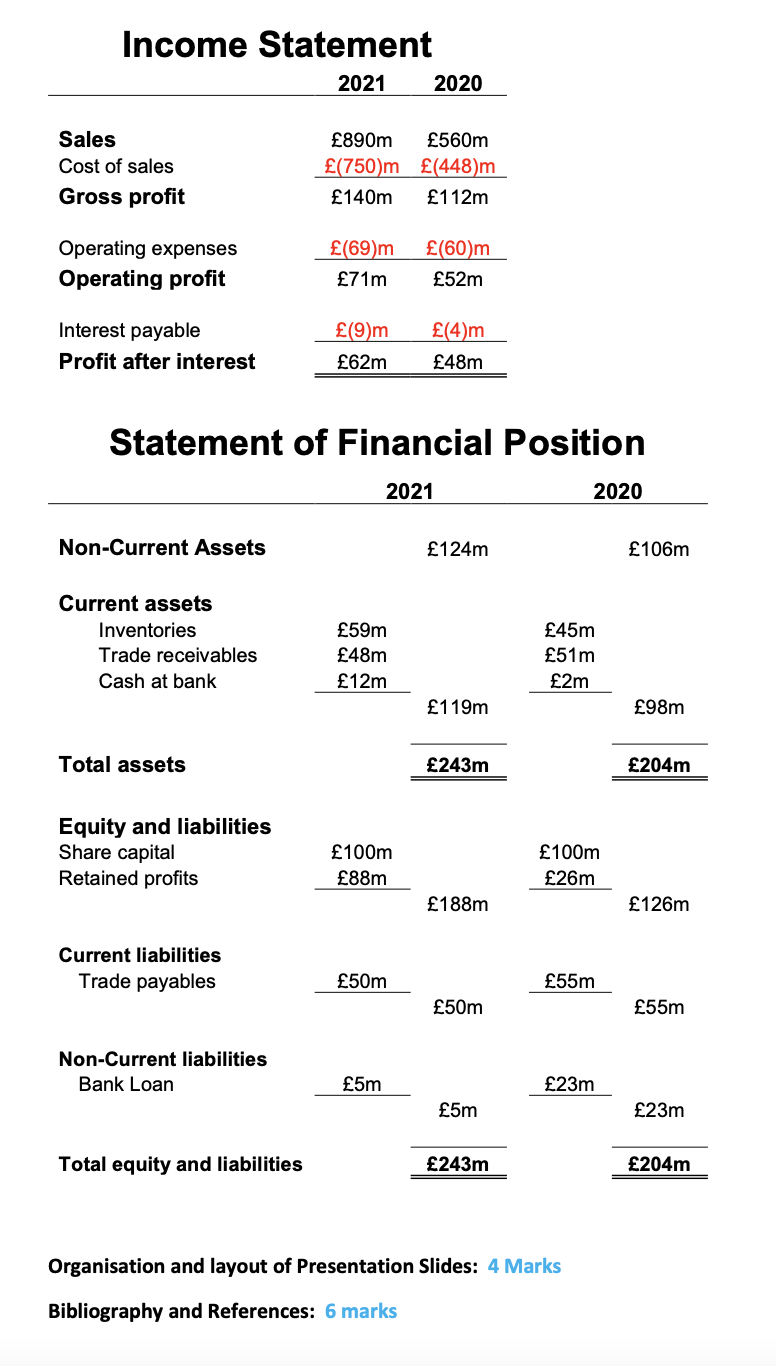

Section IV. Financial Ratios - Calculation & Interpretation Six months has now past, and Marine has experienced continued growth and expansion which has attracted the attention of Big Liner PLC, a global manufacturer and retailer of sailing clothing and accessories who are looking for potential acquisitions. They have made some approaches to the Board of Directors and have asked for some information in financial results and analysis. The Board have asked the Finance Director to produce the Financial Statements (below) and has asked her to carry out some Variance Analysis including the following ratios: . Profitability: Gross Profit Margin Operating Profit Margin Return of Equity . Liquidity: Current Ratio Quick acid test O Investment: Gearing Ratio Interest Cover . . . Efficiency: Inventory Days Receivable Days Payable Days . Using 5 of these ratios (1 each from Profitability, Liquidity, and Investment; 2 from Efficiency) explain the ratio, what it means and what it is measuring (5 marks), calculate the ratio for both years (10 marks) and discuss the results/fluctuations in the two years in relation the company (5 marks). You should also perform some research with references. Income Statement 2021 2020 Sales Cost of sales Gross profit 890m 560m (750)m (448)m 140m 112m Operating expenses Operating profit (69)m 71m (60)m 52m Interest payable Profit after interest (9)m 62m (4)m 48m Statement of Financial Position 2021 2020 Non-Current Assets 124m 106m Current assets Inventories Trade receivables Cash at bank 59m 48m 12m 45m 51m 2m 119m 98m Total assets 243m 204m Equity and liabilities Share capital Retained profits 100m 88m 100m 26m 188m 126m Current liabilities Trade payables 50m 55m 50m 55m Non-Current liabilities Bank Loan 5m 23m 5m 23m Total equity and liabilities 243m 204m Organisation and layout of Presentation Slides: 4 Marks Bibliography and References: 6 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts