Question: Section IV: Portfolio Risk, Return, & SML (a) Consider the returns for the following stocks: State Probability Apple Boom .2 18% Normal .6 9% Recession

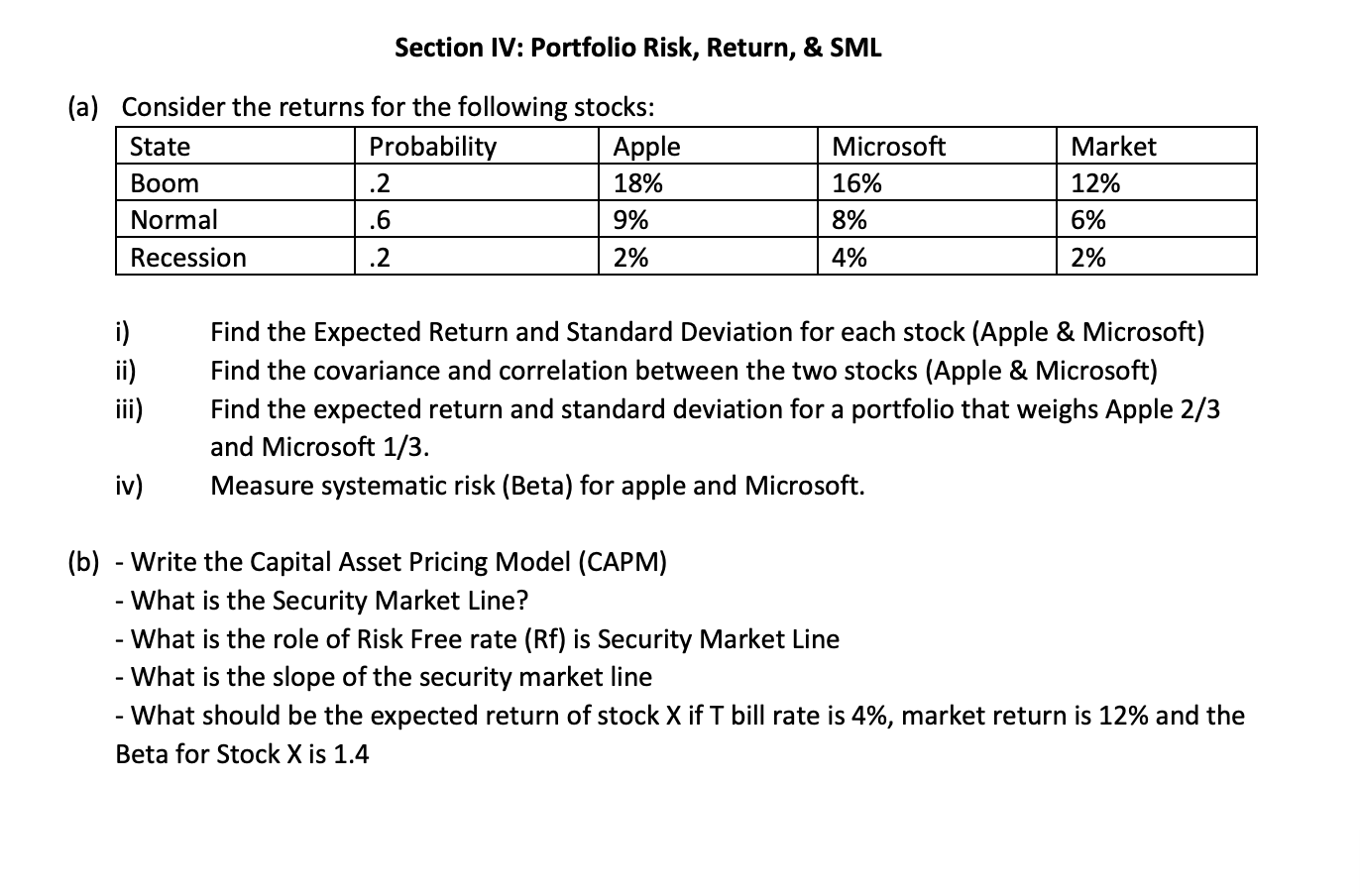

Section IV: Portfolio Risk, Return, & SML (a) Consider the returns for the following stocks: State Probability Apple Boom .2 18% Normal .6 9% Recession .2 2% Microsoft 16% 8% Market 12% 6% 4% 2% i) ii) iii) Find the Expected Return and Standard Deviation for each stock (Apple & Microsoft) Find the covariance and correlation between the two stocks (Apple & Microsoft) Find the expected return and standard deviation for a portfolio that weighs Apple 2/3 and Microsoft 1/3. Measure systematic risk (Beta) for apple and Microsoft. iv) (b) - Write the Capital Asset Pricing Model (CAPM) - What is the Security Market Line? What is the role of Risk Free rate (RF) is Security Market Line - What is the slope of the security market line - What should be the expected return of stock X if I bill rate is 4%, market return is 12% and the Beta for Stock X is 1.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts