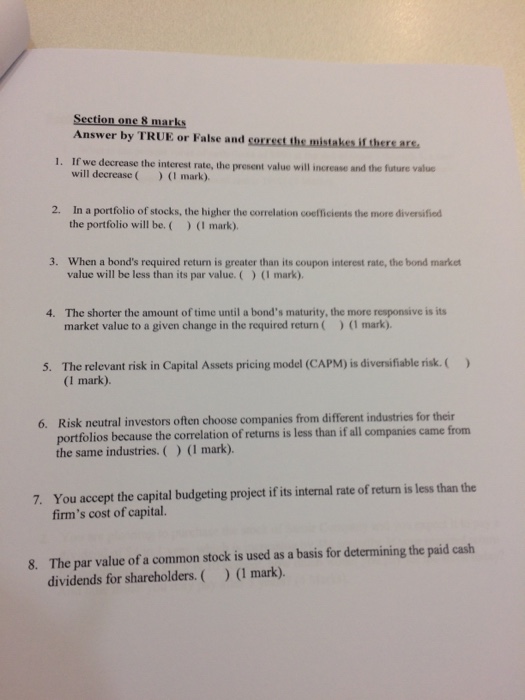

Question: Section one 8 marks Answer by TRUE or False and coxcest the mistakes.if thers ars will decrease ( mark) In a portfolio of stocks, the

Section one 8 marks Answer by TRUE or False and coxcest the mistakes.if thers ars will decrease ( mark) In a portfolio of stocks, the higher the correlation coefficients the more diversified . If we decrease the interest rate, the present value will increase and the future value 2. the portfolio will be. ) (1 mark). 3. When a bond's required return is greater than its coupon interest rate, the bond market value will be less than its par value. () (I mark). The shorter the amount of time until a bond's maturity, the more responsive is its market value to a given change in the required return(1 mark). 4. The relevant risk in Capital Assets pricing model (CAPM) is diversifiable risk ( (I mark). 5 ) 6. Risk neutral investors often choose companies from different industries for their portfolios because the correlation of retuns is less than if all companies came from the same industries.)I mark). You accept the capital budgeting project if its internal rate of return is less than the firm's cost of capital. 7. The par value of a common stock is used as a basis for determining the paid cash dividends for shareholders.)(I mark). 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts