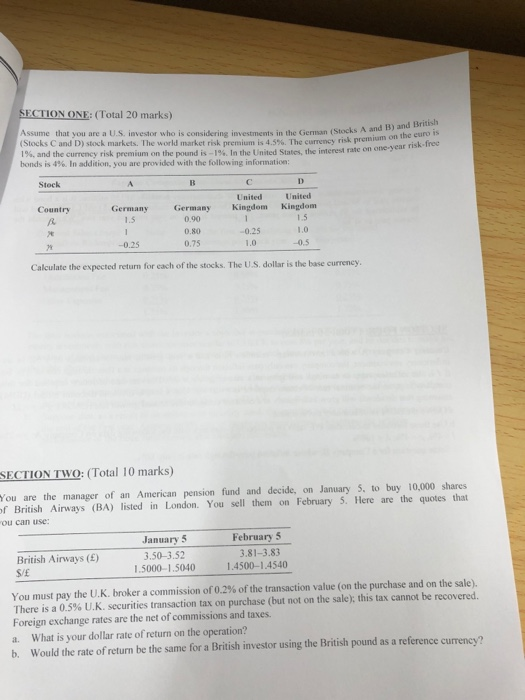

Question: SECTION ONE: (Total 20 marks) the German (Stocks A and B) and British Assume that you are a US, investor who is considering investments in

SECTION ONE: (Total 20 marks) the German (Stocks A and B) and British Assume that you are a US, investor who is considering investments in the German (Stocks A and >> (Stocks C and D) stock markets. The world market risk premium is The currency risk premium on the euro 196, and the currency risk premium on the pound is -19In the United States the interest rate on one-year riske bonds is 196. In addition, you are provided with the following information: Stock A United Kingdom United Kingdom Country Germany 1.5 Germany 0.90 0.80 0.75 0. 250 1.0 -0.25 -0.5 Calculate the expected return for each of the stocks. The US dollar is the base currency SECTION TWO: (Total 10 marks) You are the manager of an American pension fund and decide on January 5, to buy 10,000 shares of British Airways (BA) listed in London. You sell them on February 5. Here are the quotes that ou can use: January 5 February 5 British Airways () 3.50-3.52 3.81-3.83 1.5000-1.5040 1.4500-1.4540 You must pay the U.K. broker a commission of 0.2% of the transaction value (on the purchase and on the sale). There is a 0.5% U.K. securities transaction tax on purchase (but not on the sale); this tax cannot be recovered. Foreign exchange rates are the net of commissions and taxes. a. What is your dollar rate of return on the operation? b. Would the rate of return be the same for a British investor using the British pound as a reference currency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts