Question: Section Two 23 - Assume that a U.S. firm can invest funds for one year in the U.S. at 12% or invest funds of Mexico

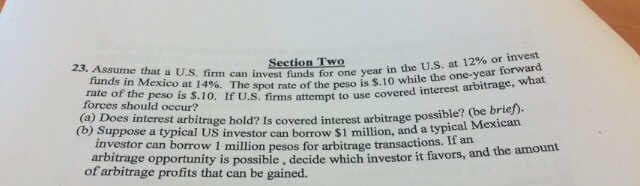

Section Two 23 - Assume that a U.S. firm can invest funds for one year in the U.S. at 12% or invest funds of Mexico at 14%. The spot rate of the peso is $.10 while the one-year forward rate of the peso $.10. If U.S. firms attempt to use covered interest arbitrage, what forces should occur? (a) Does interest arbitrage hold? Is covered interest arbitrage possible? (be brief). (b) Suppose a typical US investor can borrow $1 million, and a typical Mexican investor can borrow 1 million pesos for arbitrage transactions. If an arbitrage opportunity is possible, decide which investor it favors, and the amount of arbitrage profits that can be gained

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts