Question: Section Two: Analysis of Cash Method versus the Accrual Method A&I Enterprises is a tax consulting service. During the month of June 2 0 2

Section Two: Analysis of Cash Method versus the Accrual Method

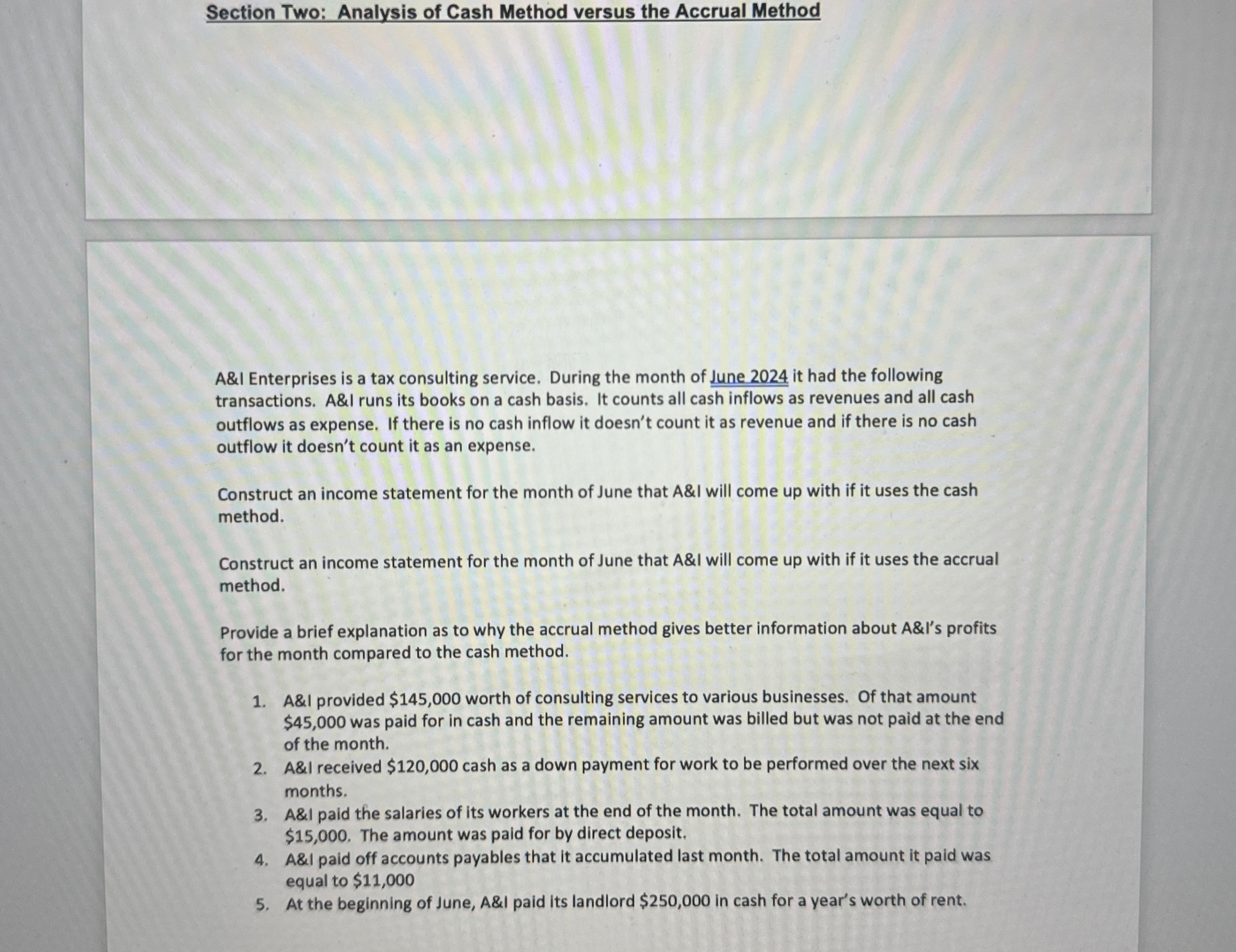

A&I Enterprises is a tax consulting service. During the month of June it had the following transactions. A&I runs its books on a cash basis. It counts all cash inflows as revenues and all cash outflows as expense. If there is no cash inflow it doesn't count it as revenue and if there is no cash outflow it doesn't count it as an expense.

Construct an income statement for the month of June that A&I will come up with if it uses the cash method.

Construct an income statement for the month of June that A&I will come up with if it uses the accrual method.

Provide a brief explanation as to why the accrual method gives better information about A&ls profits for the month compared to the cash method.

A&I provided $ worth of consulting services to various businesses. Of that amount $ was paid for in cash and the remaining amount was billed but was not paid at the end of the month.

A&I received $ cash as a down payment for work to be performed over the next six months.

A&I paid the salaries of its workers at the end of the month. The total amount was equal to $ The amount was paid for by direct deposit.

A&I paid off accounts payables that it accumulated last month. The total amount it paid was equal to $

At the beginning of June, A&I paid its landlord $ in cash for a year's worth of rent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock