Question: Section Two: Intermediate (4 points each) Suppose our company has the following capital structure, and a 33% Effective Tax Rate. Suppose that the risk-free rate

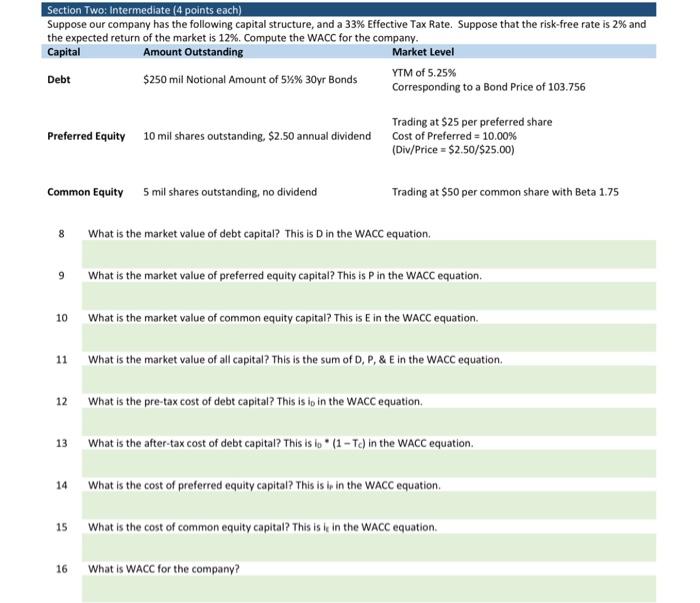

Section Two: Intermediate (4 points each) Suppose our company has the following capital structure, and a 33% Effective Tax Rate. Suppose that the risk-free rate is 2% and the expected return of the market is 12%. Compute the WACC for the company. Capital Amount Outstanding Market Level Debt $250 mil Notional Amount of 5%% 30yr Bonds YTM of 5.25% Corresponding to a Bond Price of 103.756 Trading at $25 per preferred share Preferred Equity 10 mil shares outstanding, $2.50 annual dividend cost of Preferred = 10.00% (Div/Price = $2.50/$25.00) Common Equity 5 mil shares outstanding, no dividend Trading at $50 per common share with Beta 1.75 8 What is the market value of debt capital? This is in the WACC equation. 9 What is the market value of preferred equity capital? This is Pin the WACC equation. 10 What is the market value of common equity capital? This is E in the WACC equation. 11 What is the market value of all capital? This is the sum of D. P, & E in the WACC equation 12 What is the pre-tax cost of debt capital? This is in in the WACC equation, 13 What is the after-tax cost of debt capital? This is to " (1 - Tc) in the WACC equation. 14 What is the cost of preferred equity capital? This is in in the WACC equation. 15 What is the cost of common equity capital? This is in the WACC equation. 16 What is WACC for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts