Question: SECTION V Answer all questions (12) (To receive all 12 points, you have to tell the full story, no shortcuts) Consider the two country (Canada

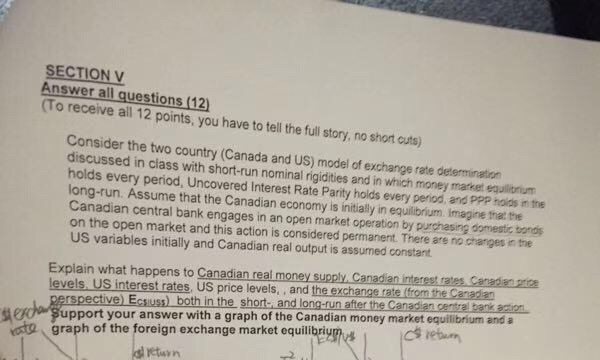

SECTION V Answer all questions (12) (To receive all 12 points, you have to tell the full story, no shortcuts) Consider the two country (Canada and US) model of exchange rate determination discussed in class with short-run nominal rigidities and in which money market equilinum holds every period, Uncovered interest Rate Parity holds every period, and PPP holds in the long-run. Assume that the Canadian economy is initially in equilibrium. Imagine that the Canadian central bank engages in an open market operation by purchasing domestic bonds on the open market and this action is considered permanent. There are no changes in the US variables initially and Canadian real output is assumed constant Explain what happens to Canadian real money supply. Canadian interest rates Canada levels, US interest rates, US price levels and the exchange rate from the Canadian perspective ECSU) both in the short and long-run after the Canadian central bank action eco Support your answer with a graph of the Canadian money market equilibrium anda varte graph of the foreign exchange market equilibrium return cebu SECTION V Answer all questions (12) (To receive all 12 points, you have to tell the full story, no shortcuts) Consider the two country (Canada and US) model of exchange rate determination discussed in class with short-run nominal rigidities and in which money market equilinum holds every period, Uncovered interest Rate Parity holds every period, and PPP holds in the long-run. Assume that the Canadian economy is initially in equilibrium. Imagine that the Canadian central bank engages in an open market operation by purchasing domestic bonds on the open market and this action is considered permanent. There are no changes in the US variables initially and Canadian real output is assumed constant Explain what happens to Canadian real money supply. Canadian interest rates Canada levels, US interest rates, US price levels and the exchange rate from the Canadian perspective ECSU) both in the short and long-run after the Canadian central bank action eco Support your answer with a graph of the Canadian money market equilibrium anda varte graph of the foreign exchange market equilibrium return cebu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts