Question: Section1: Multiple choice questions (2 points each) M I. The common stock of Auto Deliveries sells for $28.16 a share. The stock is expected to

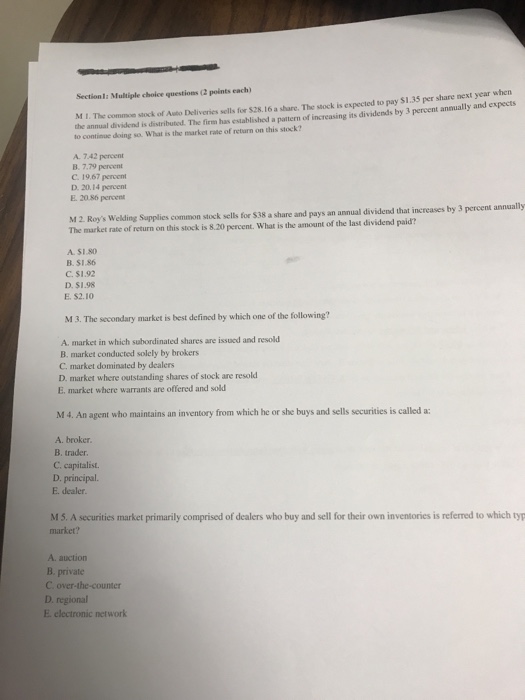

Section1: Multiple choice questions (2 points each) M I. The common stock of Auto Deliveries sells for $28.16 a share. The stock is expected to pay $1.35 per share next year the annual dividend is distributed. The firm has established a patern of increasing its dividends by 3 percent annually and expects to continue doing so. What is the market rate of return on this stock? A. 7.42 percent B. 7.79 percent C. 19.67 percent D. 20.14 percent E. 20.86 percent M 2 Roy's Welding Supplics common stock sells for $38 a share and pays an annual dividend that inecreases by 3 percent annually The market rate of return on this stock is 8.20 percent. What is the amount of the last dividend paid? A. S1.80 B. SI.86 C. $1.92 D. $1.98 E. $2.10 M 3. The secondary market is best defined by which one of the following? A. market in which subordinated shares are issued and resold B. market conducted solely by brokers C. market dominated by dealers D. market where outstanding shares of stock are resold E. market where warrants are offered and sold M 4. An agent who maintains an inventory from which he or she buys and sells securities is called a A. broker. B. trader C. capitalist. D. principal E. dealer. M 5. A securities market primarily comprised of dealers who buy and sell for their own inventories is referred to which typ market? A. auction B private C over-the-counter D. regional E. electronic network

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts