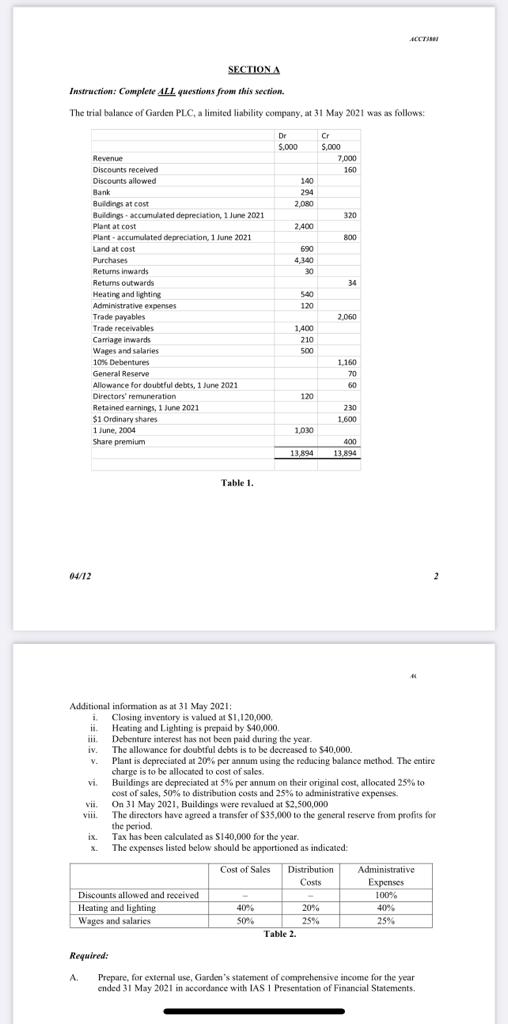

Question: SECTIONA Instruction: Complete ALL questions from this section. The trial balance of Garden PLC , a limited liability company, at 3 1 May 2 0

SECTIONA

Instruction: Complete ALL questions from this section.

The trial balance of Garden PLC a limited liability company, at May was as follows:

Table

Additional information as at May ;

i Closing inventory is valued at $

ii Heating and Lighting is prepaid by $

iii. Debenture interest has not been paid during the year.

iv The allowance for doubtul debts is to be decreased to $

v Plant is depreciated at per annum using the redacing balance method. The entirc

charge is to be allocated to cost of sales.

vi Buildings are depreciated at per annum on their original cost, allocated to

cost of sales, to distribution costs and to administrative expenses.

vii. Oa May Buildings were revalued at $

vii. The directors have agred a transfer of $ to the general reserve from profits for

the period.

ix Tax has been calculated as $ for the year.

x The expenses listed below should be apportioned as indicated:

Table

Required:

A Prepare, for external use, Ganden's statement of comprehensive income for the year

ended May in accordance with IAS Presentation of Financial Statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock