Question: SECTIONA Question 1 a) Carefully explain the market model proposed by Sharpe (1963). [50] b) Carefully explain the main limitations of the Markowtiz model. (20)

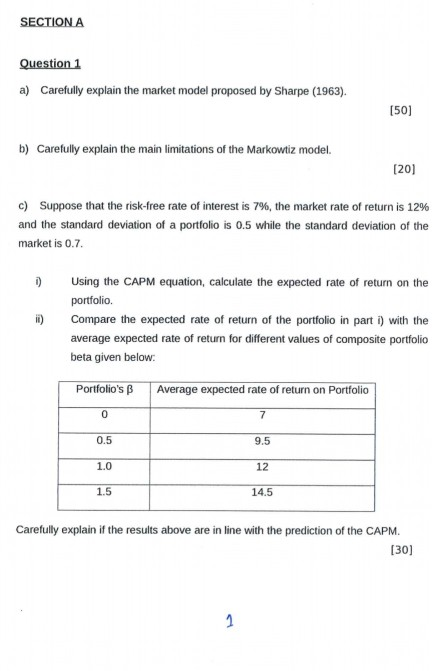

SECTIONA Question 1 a) Carefully explain the market model proposed by Sharpe (1963). [50] b) Carefully explain the main limitations of the Markowtiz model. (20) c) Suppose that the risk-free rate of interest is 796, the market rate of return is 12% and the standard deviation of a portfolio is 0.5 while the standard deviation of the market is 0.7 Using the CAPM equation, calculate the expected rate of return on the portfolio. i) Compare the expected rate of return of the portfolio in part i) with the average expected rate of return for different values of composite portfolio beta given below Portfolio's 0 0.5 1.0 1.5 | Average expected rate of return on Portfolio 9.5 12 14.5 Carefully explain if the results above are in line with the prediction of the CAPM. [30]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts