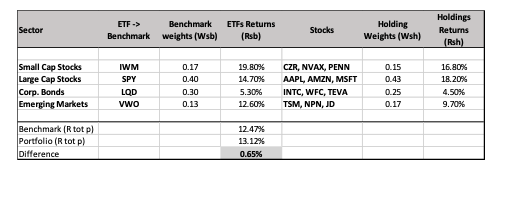

Question: Sector ETF-> Benchmark Benchmark weights (Wsb) ETFs Returns (Rsb) Stocks Holding Weights (Wsh) Holdings Returns (Rsh) Small Cap Stocks Large Cap Stocks Corp. Bonds Emerging

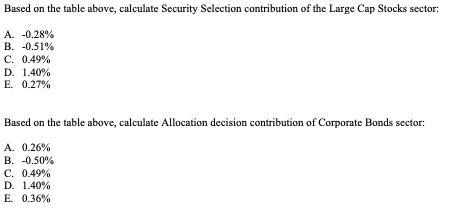

Sector ETF-> Benchmark Benchmark weights (Wsb) ETFs Returns (Rsb) Stocks Holding Weights (Wsh) Holdings Returns (Rsh) Small Cap Stocks Large Cap Stocks Corp. Bonds Emerging Markets IWM SPY LOD vwo 0.17 0.40 0.30 0.13 19.80% 14.70% 5.30% 12.60% CZR, NVAX, PENN AAPL, AMZN, MSFT INTC, WFC, TEVA TSM, NPN, JD 0.15 0.43 0.25 0.17 16.80% 18. 20% 4.50% 9.70% Benchmark (R tot pl Portfolio (tot p) Difference 12.47% 13.12% 0.65% Based on the table above, calculate Security Selection contribution of the Large Cap Stocks sector: A. -0.28% B. -0.51% C. 0.49% D. 1.40% E. 0.27% Based on the table above, calculate Allocation decision contribution of Corporate Bonds sector: A. 0.26% B. -0.50% C. 0.49% D. 1.40% E. 0.36%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts