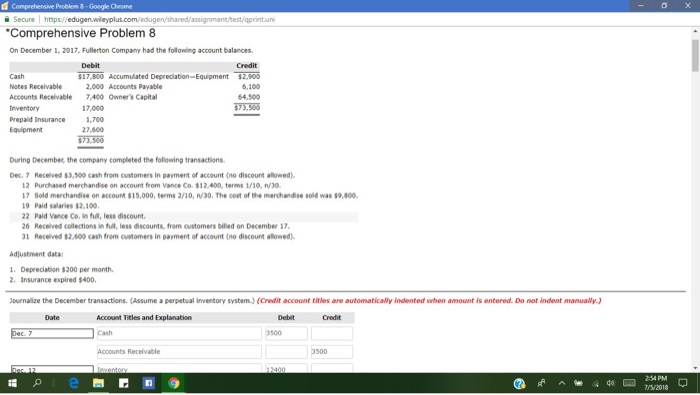

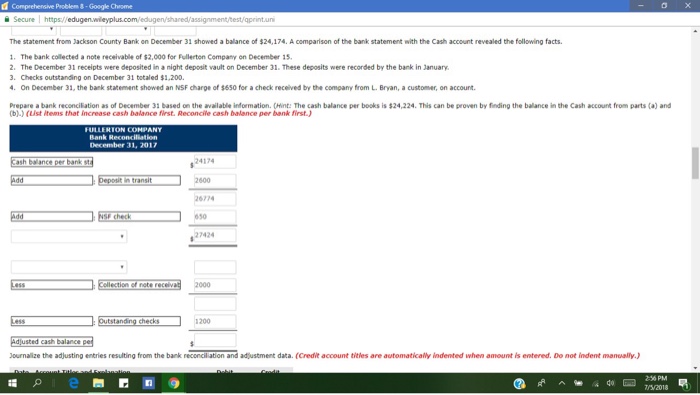

Question: Secure | https: Comprehensive Problem 8 On December 1, 2017, Fullerton Company had the following account balances Notes Receivable Accounts Receivable 7400 Owner's Capital 6,100

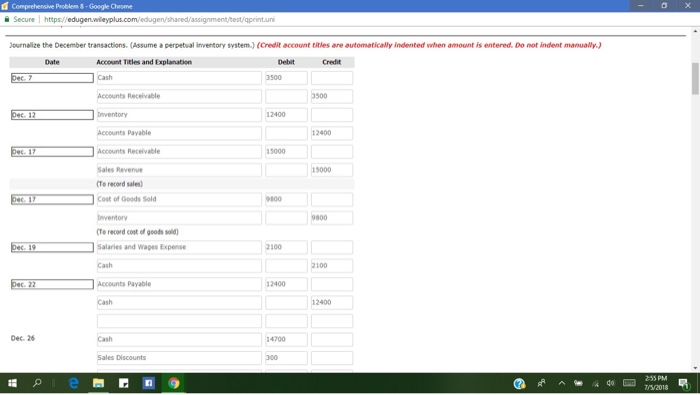

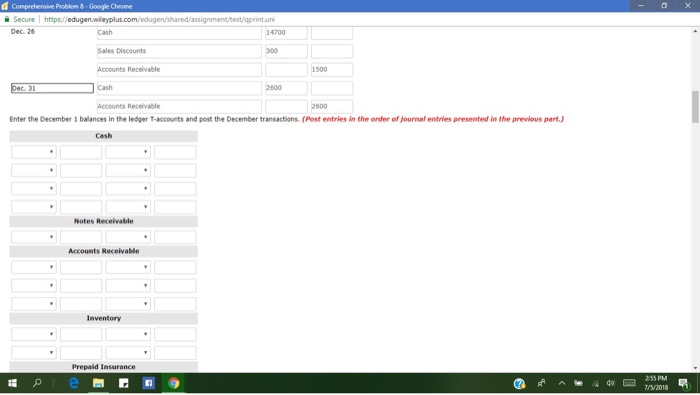

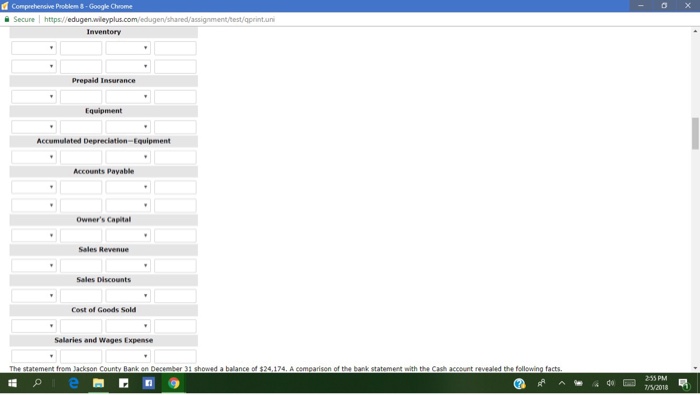

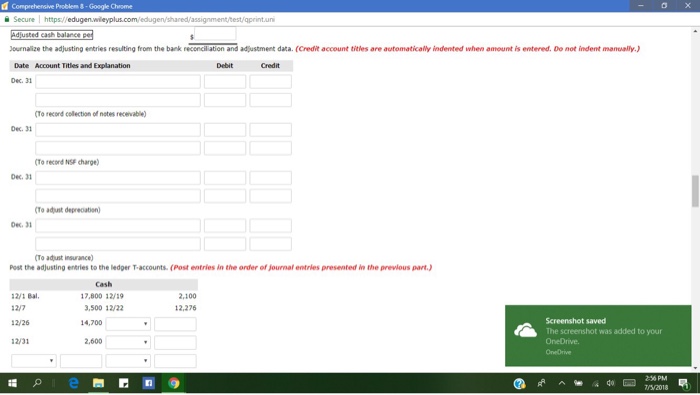

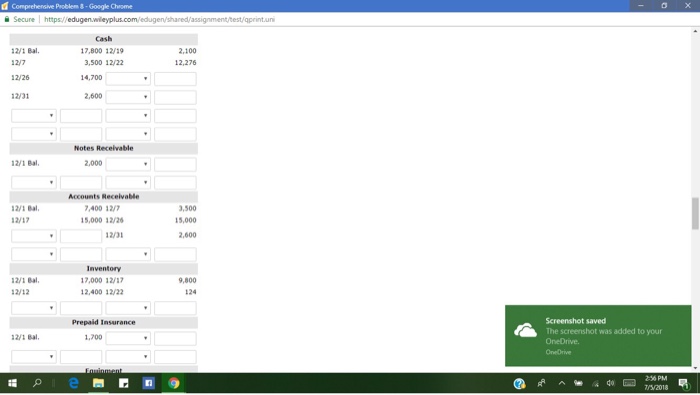

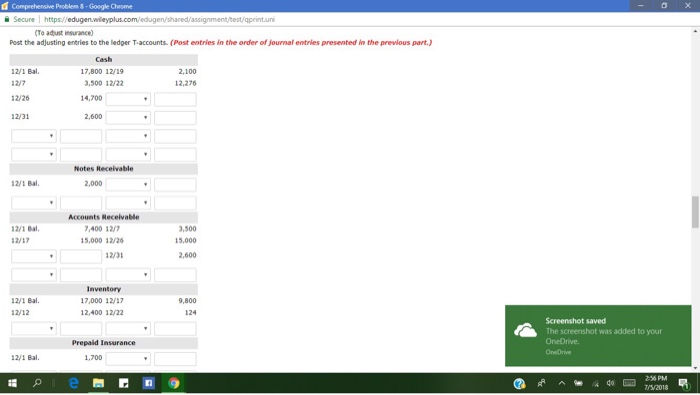

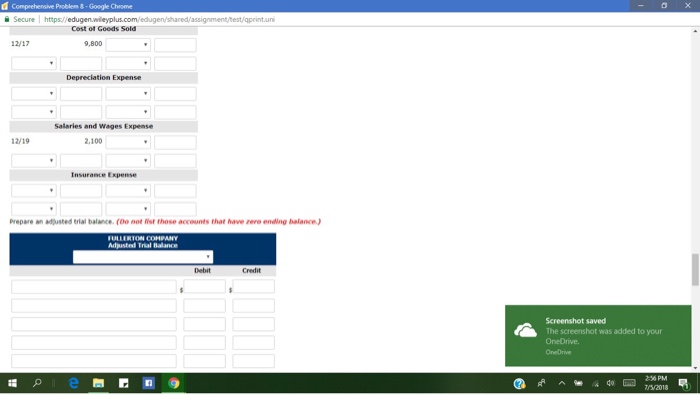

Secure | https: Comprehensive Problem 8 On December 1, 2017, Fullerton Company had the following account balances Notes Receivable Accounts Receivable 7400 Owner's Capital 6,100 4,500 ?? 2,000 Accounts Payable 17,000 1,700 27,600 Prepaid Insurance During December, the company completed the folowing transactions Dec. 7 Received $3,500 cash from customers in payment of account (no discount allowed) 12 Purchased merchandise on account from Vance Co. $12.400, terms 1/10, n/3 17 Sold merchandise on account S 15.000, terms 2/10. n/30?Tho (ost of the merchandise sold was s9.800. 19 Paid salaries 2,100 22 Paid Vance Co. in fuil, less discount 26 Recelved collections in ful, less discounts, frem oustomers biled on December 17 1 Received $2,600 cash from customers in payment of account (no discount allowed) Adjustment data: I. Depreciation $200 per month 2. Insurance expired $400. Journalize the December transactions. (Assume a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manualy.) Date Account Titles and Explanation Recelvable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts