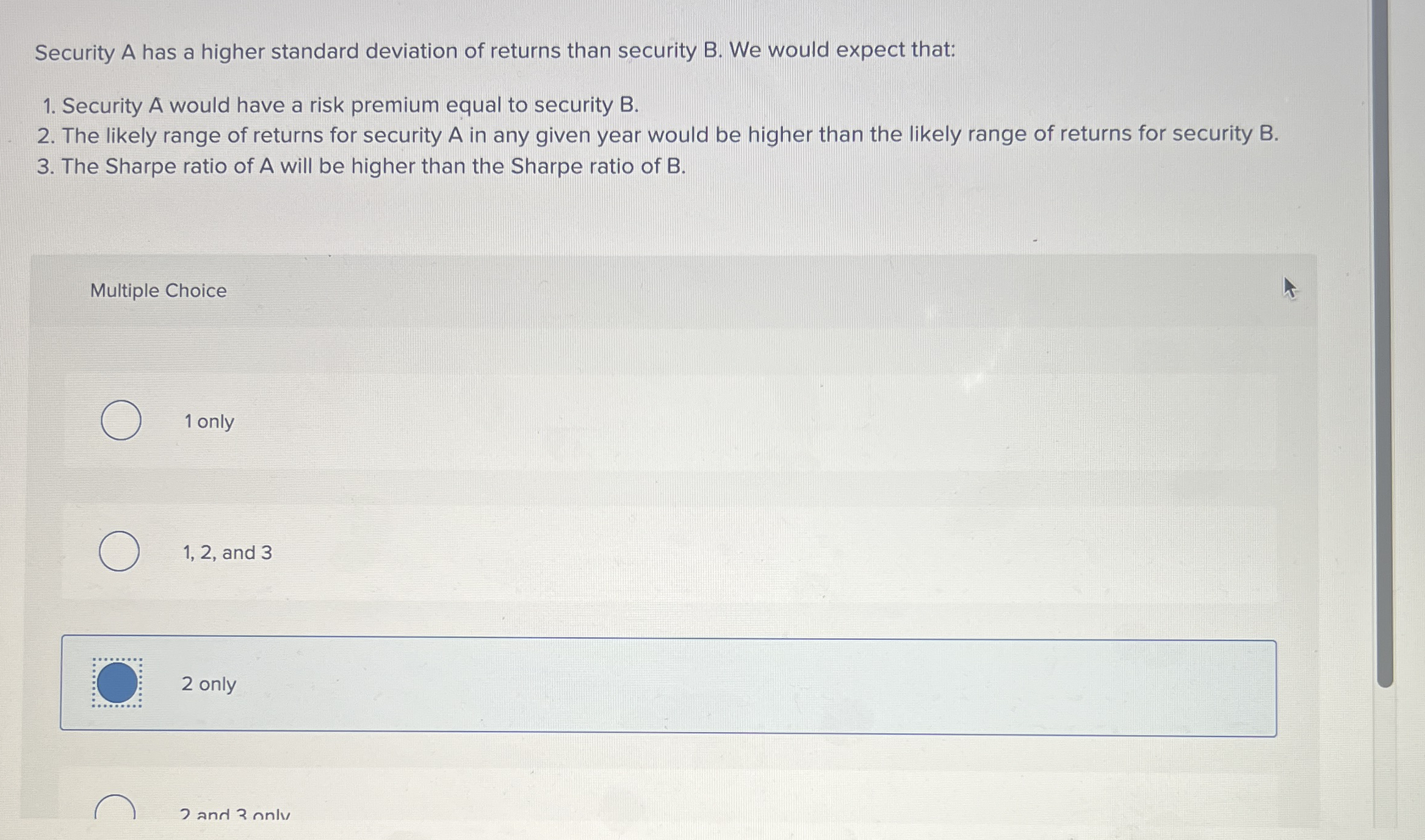

Question: Security A has a higher standard deviation of returns than security B . We would expect that: Security A would have a risk premium equal

Security A has a higher standard deviation of returns than security B We would expect that:

Security A would have a risk premium equal to security

The likely range of returns for security in any given year would be higher than the likely range of returns for security

The Sharpe ratio of A will be higher than the Sharpe ratio of

Multiple Choice

only

and

only

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock