Question: Security A has an expected return of 8% and a standard deviation of 6.2%. Security B has an expected return of 10% and a standard

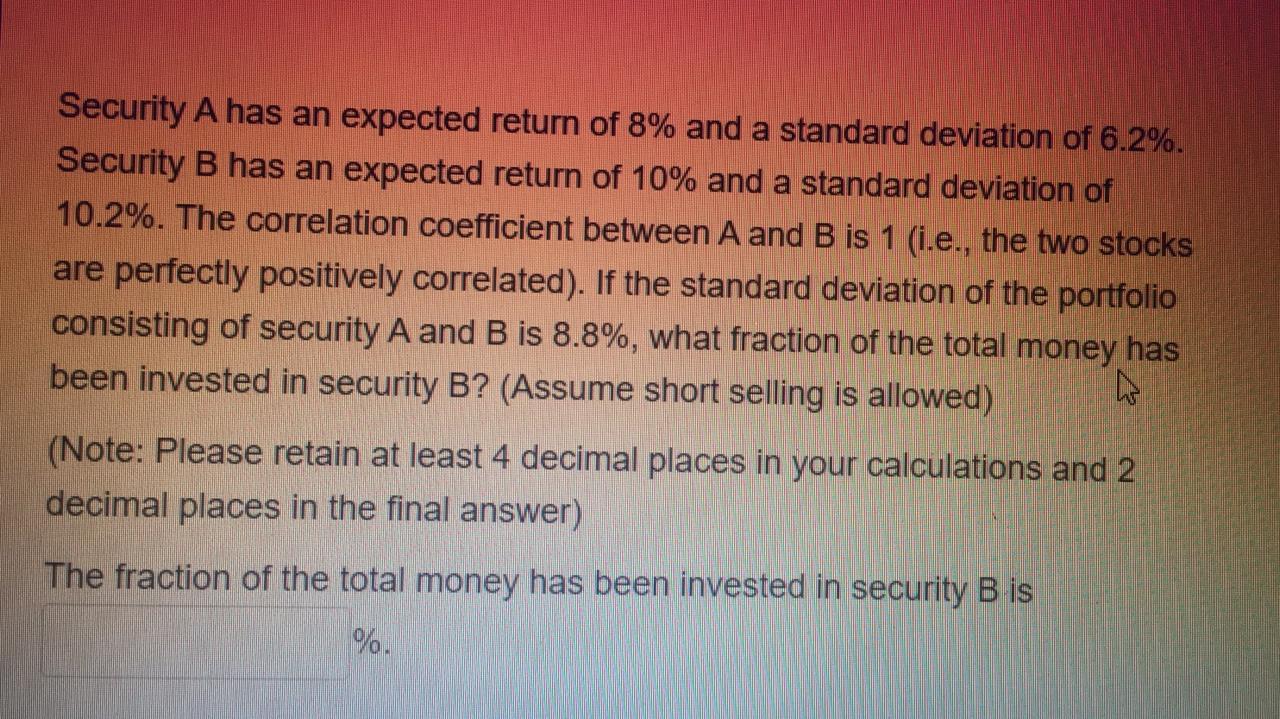

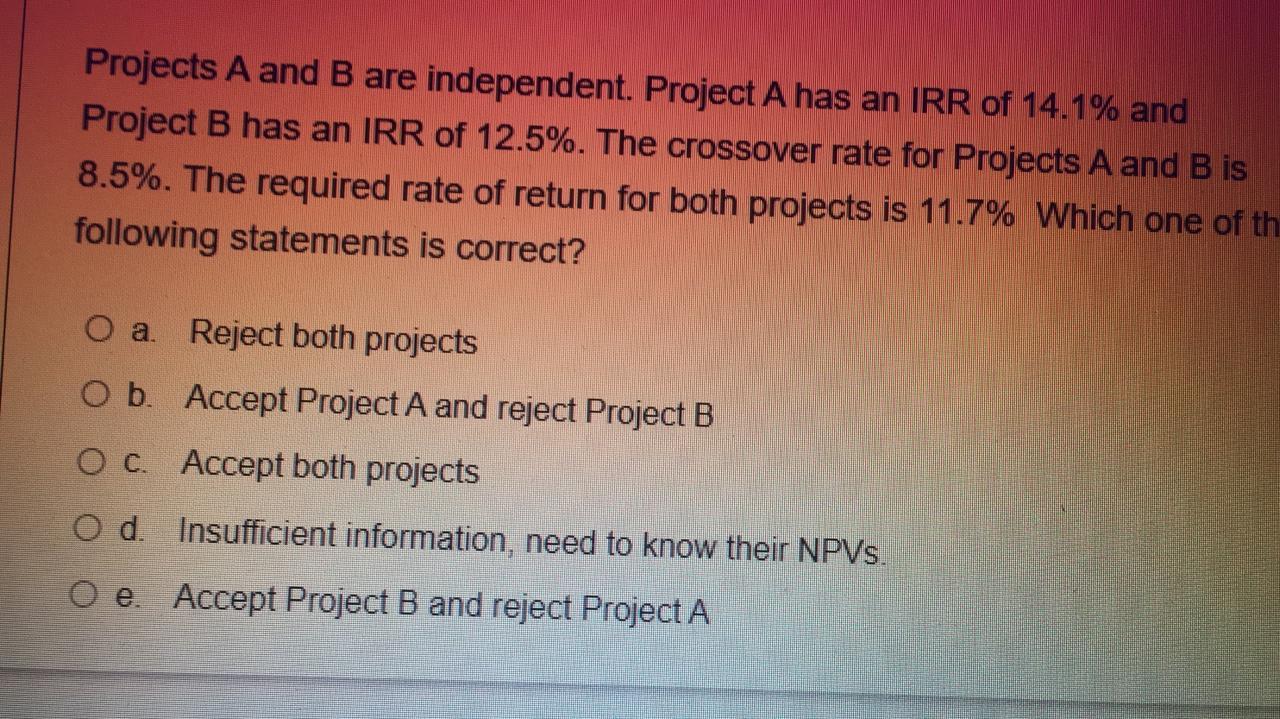

Security A has an expected return of 8% and a standard deviation of 6.2%. Security B has an expected return of 10% and a standard deviation of 10.2%. The correlation coefficient between A and B is 1 (i.e., the two stocks are perfectly positively correlated). If the standard deviation of the portfolio consisting of security A and B is 8.8%, what fraction of the total money has w been invested in security B? (Assume short selling is allowed) (Note: Please retain at least 4 decimal places in your calculations and 2 decimal places in the final answer) The fraction of the total money has been invested in security B is %. Projects A and B are independent. Project A has an IRR of 14.1% and Project B has an IRR of 12.5%. The crossover rate for Projects A and B is 8.5%. The required rate of return for both projects is 11.7% Which one of th following statements is correct? O a Reject both projects O b. Accept Project A and reject Project B OC. Accept both projects O d. Insufficient information, need to know their NPVs. O e. Accept Project B and reject Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts