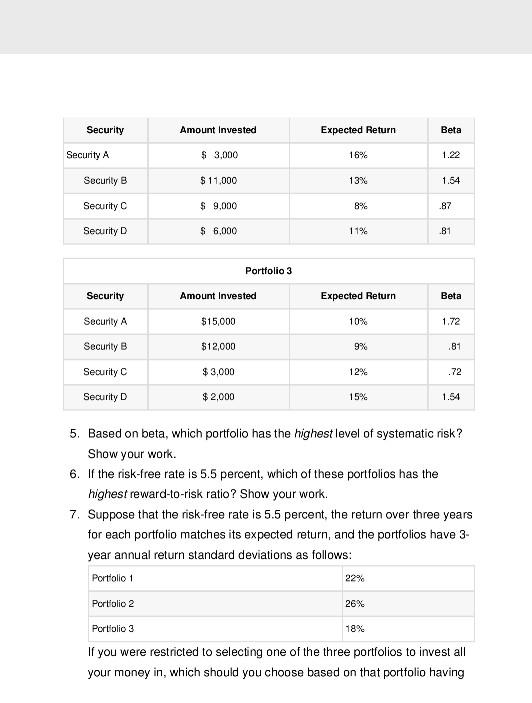

Question: Security Amount Invested Expected Return Beta Security A $ 3,000 16% 1.22 Security B $11,000 13% 1.54 Security C $ 9,000 8% .87 Security D

Security Amount Invested Expected Return Beta Security A $ 3,000 16% 1.22 Security B $11,000 13% 1.54 Security C $ 9,000 8% .87 Security D $ 6,000 11% .81 Portfolio 3 Security Amount Invested Expected Return Beta Security A $15,000 10% 1.72 Security B $12,000 9% .81 Security C $3,000 12% .72 Security D $ 2.000 15% 1.54 5. Based on beta, which portfolio has the highest level of systematic risk? Show your work. 6. If the risk-free rate is 5.5 percent, which of these portfolios has the highest reward-to-risk ratio? Show your work. 7. Suppose that the risk-free rate is 5.5 percent, the return over three years for each portfolio matches its expected return, and the portfolios have 3- year annual return standard deviations as follows: Portfolio 1 22% Portfolio 2 26% Portiolio 3 18% If you were restricted to selecting one of the three portfolios to invest all your money in, which should you choose based on that portfolio having Security Amount Invested Expected Return Beta Security A $ 3,000 16% 1.22 Security B $11,000 13% 1.54 Security C $ 9,000 8% .87 Security D $ 6,000 11% .81 Portfolio 3 Security Amount Invested Expected Return Beta Security A $15,000 10% 1.72 Security B $12,000 9% .81 Security C $3,000 12% .72 Security D $ 2.000 15% 1.54 5. Based on beta, which portfolio has the highest level of systematic risk? Show your work. 6. If the risk-free rate is 5.5 percent, which of these portfolios has the highest reward-to-risk ratio? Show your work. 7. Suppose that the risk-free rate is 5.5 percent, the return over three years for each portfolio matches its expected return, and the portfolios have 3- year annual return standard deviations as follows: Portfolio 1 22% Portfolio 2 26% Portiolio 3 18% If you were restricted to selecting one of the three portfolios to invest all your money in, which should you choose based on that portfolio having

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts