Question: Security Analysis Homework! Help needed #7 & 8 For the next two (2) questions use the information below for JBS Inc. EBIT=$10 Tax rate =35%

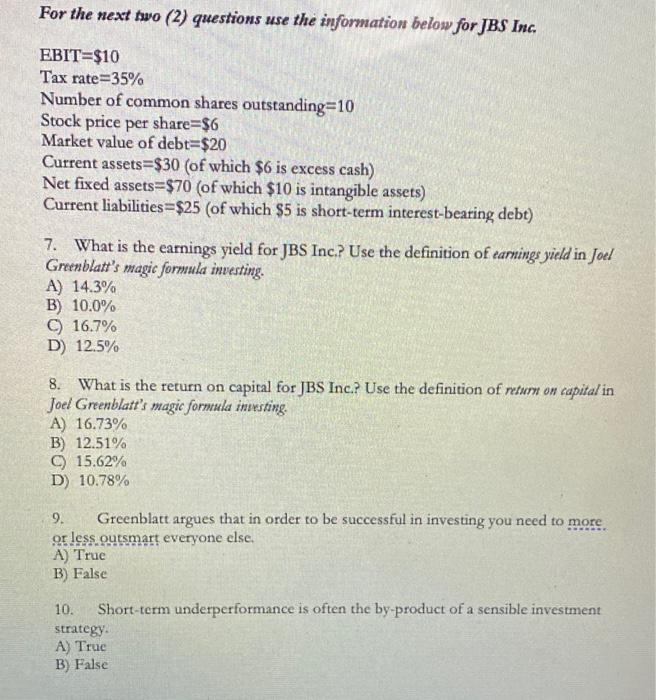

For the next two (2) questions use the information below for JBS Inc. EBIT=$10 Tax rate =35% Number of common shares outstanding =10 Stock price per share =$6 Market value of debt =$20 Current assets =$30 (of which $6 is excess cash) Net fixed assets =$70 (of which $10 is intangible assets) Current liabilities =$25 (of which $5 is short-term interest-beating debt) 7. What is the earnings yield for JBS Inc? Use the definition of earmings yield in Joel Greenblatt's magic formula investing. A) 14.3% B) 10.0% C) 16.7% D) 12.5% 8. What is the return on capital for JBS Inc.? Use the definition of retum on capital in Joel Greenblatt's magic formula imisting. A) 16.73% B) 12.51% C) 15.62% D) 10.78% 9. Greenblatt argues that in order to be successful in investing you need to more. or less.oustsmart everyone else. A) True B) False 10. Short-term underperformance is often the by-product of a sensible investment strategy. A) True B) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts