Question: Security Analysis Homework question help Sisters Corp expects to earn $6 per share next year. The firm's ROE is 15% and its plowback (retention) ratio

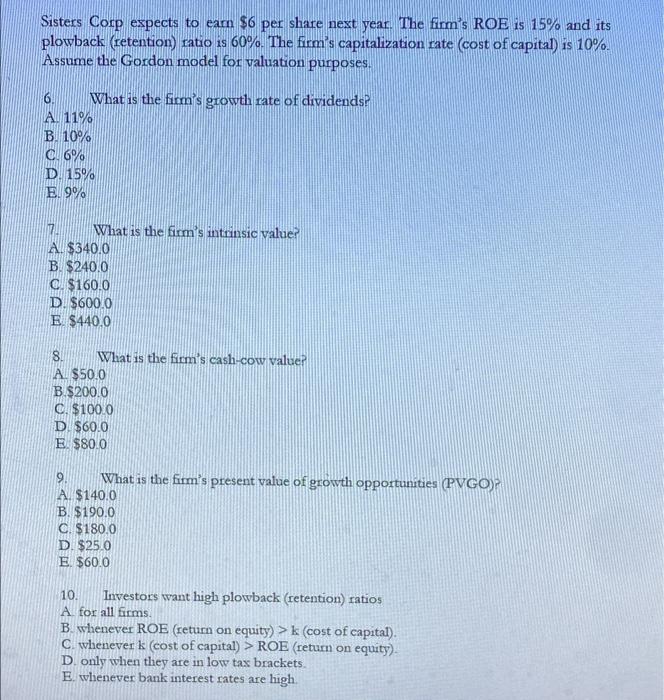

Sisters Corp expects to earn \$6 per share next year. The firm's ROE is 15% and its plowback (retention) ratio is 60\%. The firm's capitalization rate (cost of capital) is 10%. Assume the Gordon model for valuation purposes. 6. What is the firm's growth rate of dividends? A. 11% B. 10% C. 6% D. 15% E. 9% 7. What is the firm's intrinsic value? A. $340.0 B. $240.0 C. $160.0 D. $6000 E. $440.0 8. What is the firm's cash-cow value? A. $50.0 B. $200.0 C. $1000 D. $60.0 E. $80.0 9. What is the firm's present value of growth opportunities (PVGO)? A. $140.0 B. $190.0 C. $180.0 D. $250 E. $60.0 10. Investors want high plowback (retention) ratios A for all firms. B. whenever ROE (return on equity) >k (cost of capital). C. whenever k (cost of capital) >ROE (return on equity). D. only when they are in low tax brackets. E. whenever bank interest rates are high

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts