Question: Security Analysis question help 2 11. The market capitalization rate on the stock of Aberdeen Wholesale Company is 10%. It expected ROE is 12%, and

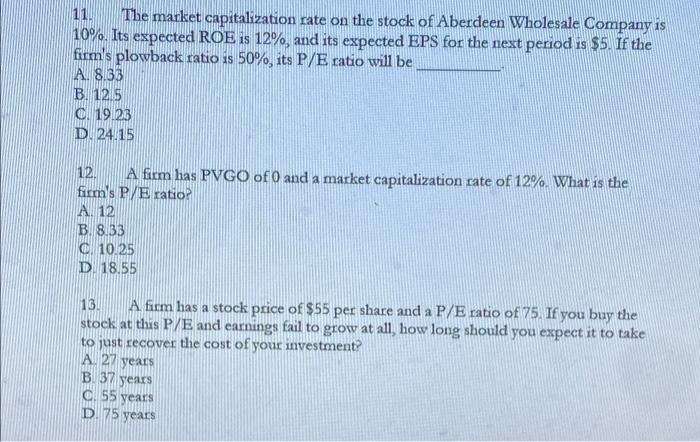

11. The market capitalization rate on the stock of Aberdeen Wholesale Company is 10%. It expected ROE is 12%, and its expected EPS for the next period is $5. If the firm's plowback ratio is 50%, its P/E ratio will be A. 8.33 B. 12.5 C. 19.23 D. 24.15 12. A firm has PVGO of 0 and a market capitalization rate of 12%. What is the firm's P/E ratio? A. 12 B. 8.33 C. 10.25 D. 18.55 13. A firm has a stock price of $55per share and a P/ E ratio of 75 . If you buy the stock at this P / E and earnings fail to grow at all, how long should you expect it to take to just recover the cost of your investment? A. 27 years B. 37 jears C. 55 years D. 75 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts