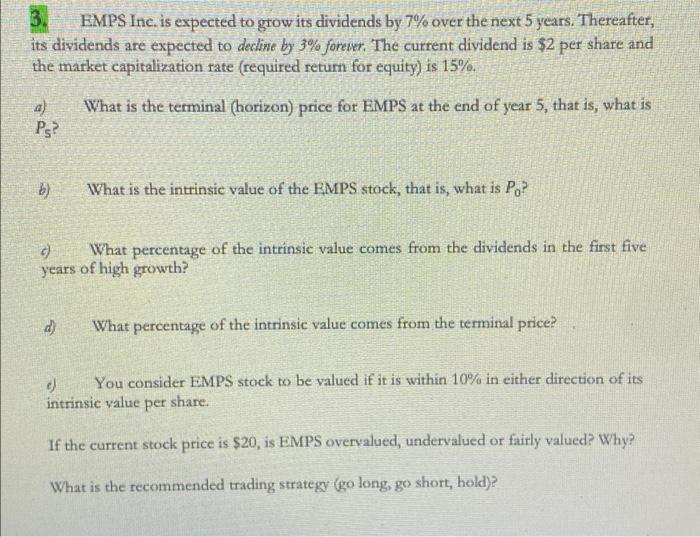

Question: Security Analysis question help! 3. EMPS Inc, is expected to grow its dividends by 7% over the next 5 years. Thereafter, its dividends are expected

3. EMPS Inc, is expected to grow its dividends by 7% over the next 5 years. Thereafter, its dividends are expected to declime by 3% foreier. The current dividend is $2 per share and the market capitalization rate (required return for equity) is 15%. a) What is the terminal (horizon) price for EMPS at the end of year 5 , that is, what is P5? b) What is the intrinsic value of the RMPS stock, that is, what is P0 ? 6) What percentage of the intrinsic value comes from the dividends in the first five years of high growth? d) What percentage of the intrinsic value comes from the terminal price? c) You consider EMPS stock to be valued if it is within 10% in either direction of its intrinsic value per share. If the current stock price is $20, is EMPS overvalued, undervalued or fairly valued? Why? What is the recommended trading strategy (go long, go short, hold)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts