Question: Security A's expected return is 10% while the expected return of B is 14%. The standard deviation of A's returns is 5%, and it is

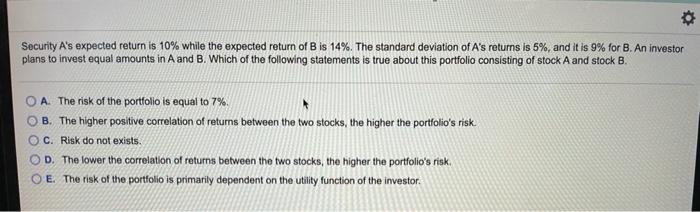

Security A's expected return is 10% while the expected return of B is 14%. The standard deviation of A's returns is 5%, and it is 9% for B. An investor plans to invest equal amounts in A and B. Which of the following statements is true about this portfolio consisting of stock A and stock B. O A. The risk of the portfolio is equal to 7% OB. The higher positive correlation of returns between the two stocks, the higher the portfolio's risk. C. Risk do not exists. OD. The lower the correlation of returns between the two stocks, the higher the portfolio's risk O E. The risk of the portfolio is primarily dependent on the utility function of the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts