Question: SECURITY CLASSIFICATION: OFFICIAL ( CLOSED ) , NON - SENSITIVE Metro Car Washes, Inc, is reviewing an investment proposal. The initial cost as well as

SECURITY CLASSIFICATION: OFFICIAL CLOSED NONSENSITIVE

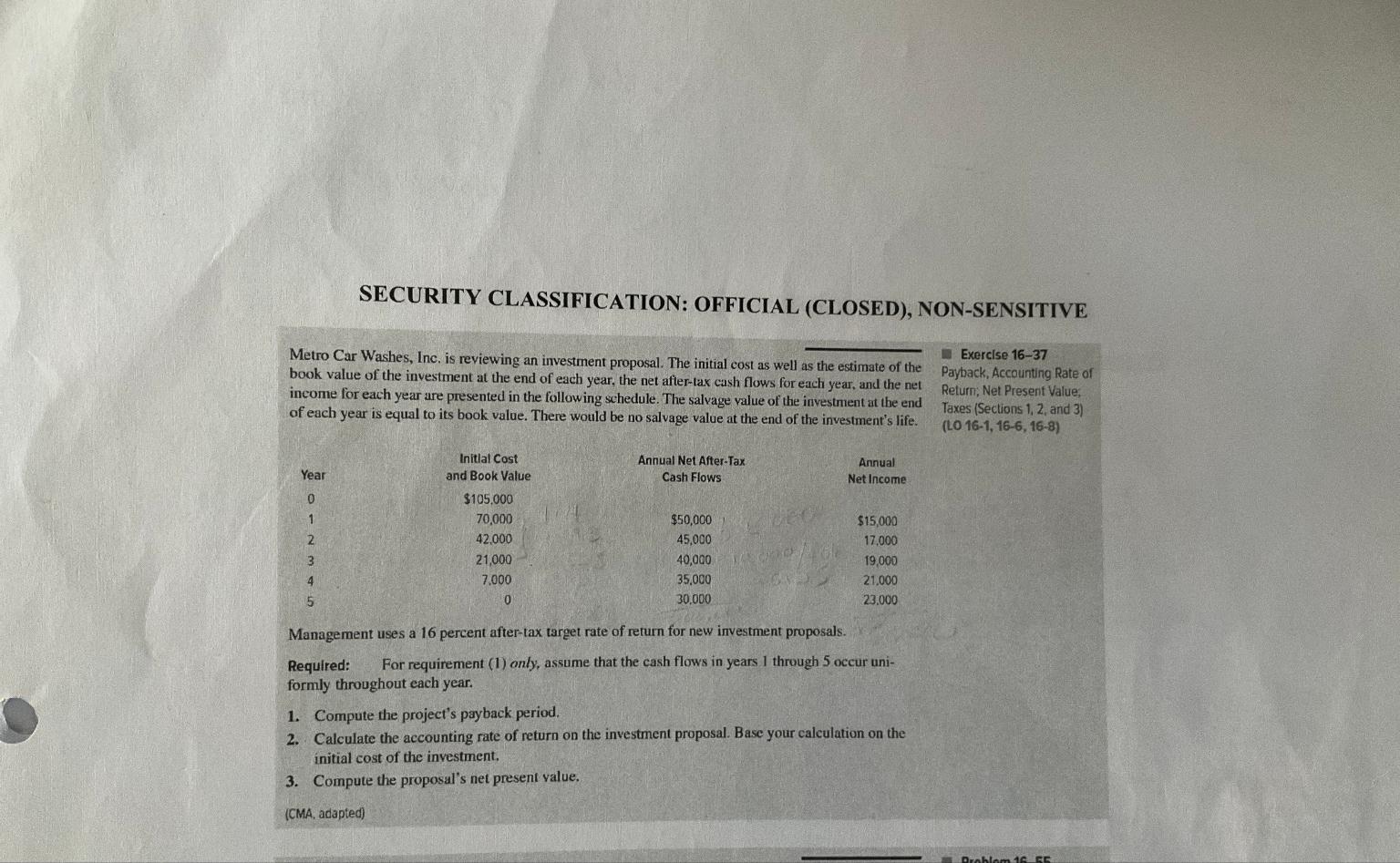

Metro Car Washes, Inc, is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net aftertax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life.

Year

Initlal Cost and Book Value

$

Annual Net AfterTax Cash Flows

Annual Net Income

$

Exerclse

Payback, Accounting Rate of Return, Net Present Value; Taxes Sections and LO

Management uses a percent aftertax target rate of return for new investment proposals.

Required: For requirement only, assume that the cash flows in years through occur uniformly throughout each year.

Compute the project's payback period.

Calculate the accounting rate of return on the investment proposal. Base your calculation on the initial cost of the investment.

Compute the proposal's net present value.

CMA adapted

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock